Nah, there are administrative fees and monthly overhead with an inactive customer.

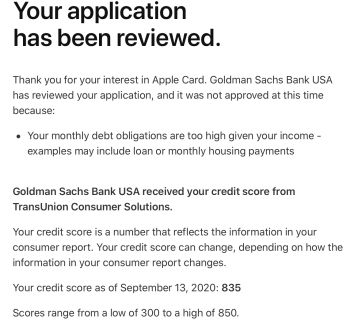

I haven't used my Apple Card for a year because of Goldman Sachs' utter incompetence and garbage customer service.

Yes, I could cancel the card and take the short-term credit score hit. However, it's more punishing to GS if I stay on as an inactive customer. They still need to process my account and send me the monthly account statement.

Worse, I have an $0.13 Apple Card cash reward credit.

GS could cancel my account for inactivity but they would be on the hook to send me thirteen cents. Consumer banking laws are pretty strict and I wouldn't be surprised if GS needs to accrue $0.13 cash to ensure they can hand back my property to me when I demand it or when our contractual agreement is over.

First-class postage is more than that but the processing to cancel my account, send me the notification (by snail mail) and actually mail me a check would probably exceed $30-40 to GS.

I believe GS was quoted stating that the new customer acquisition cost was around $200 per account. The fancy titanium physical Apple Card has never left my house, has never been used in a single transaction. This is one example of a GS new customer acquisition cost that will unlikely never be recouped.

They even have a program where a customer can request for a postage paid box to send an unwanted card back to be safely and securely destroyed. That's an additional cost that I have not yet invoked.

I signed up for Apple Card, GS customer service effed up in less than two months and now we're at a stalemate. I have the upper hand because they owe me thirteen cents. With each day my credit history grows with this issuer and my credit utilization is zero. The two months I actually charged something, I made the payments before the close date. With the ongoing $0.13 credit, there is no question of me not making payments.

I am not the debtor, I am the creditor. Consumer credit card companies loathe being debtors. But right now, that's where GS and I stand. They owe me money.

GS should love to dump me as a customer but it's too costly for them to give me the boot.