Link

AT&T will pay Qualcomm $1.93 billion for a swath of spectrum licenses, as AT&T looks to bolster its fourth-generation service while Qualcomm plans to shut down its FLO TV service. Dow Jones reports:

The wireless chip manufacturer in October announced a device-sales suspension for its mobile broadcast video service, taking the first steps toward scuttling its entire project and freeing up some valuable wireless spectrum for sale. At the time, Qualcomm said customers would continue to receive programming into the spring.

It disclosed Monday that FLO TV will be shut down in March. Qualcomm had already disclosed restructuring charges of up to an estimated $175 million related to the October announcement, and the figure is expected to grow.

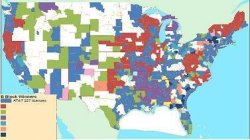

AT&T is buying spectrum licenses in the lower 700MHz frequency band. It plans to deploy the spectrum as part of longer-term plans for its fourth-generation network, once compatible handsets and network equipment are developed. The companies expect the sale to close in the second half of 2011.

The analysts seem to like the look of the deal. UBS Maynard Um writes that the deal could mean good things for Qualcomm investors looking forward to dividend boosts and buybacks:

We also view the sale as a positive as presumably the $1.925 [billion] sale price will increase QCOMs domestic cash balance & should help support a dividend increase which we expect in fiscal 2Q11 (March 11 qtr), as well as share repurchases.

As far as AT&T is concerned, Cowen & Co. analyst Colby Synesael sees purchase of spectrum, which is essentially licenses to use a portion of the airwaves in a particular region, as a postive. We cant help but wonder whether the deal will mean anything positive for iPhone users in markets such as San Francisco and New York who have been less than thrilled with AT&T service. Synesael writes:

The 12 MHz spectrum is in five of the top 15 U.S. metropolitan areas including New York and San Francisco where AT&T has had coverage issues in the past.