Apple's "cash" is the combination of its short and long-term "marketable securities" and the actual cash balances it maintains in its various bank accounts.

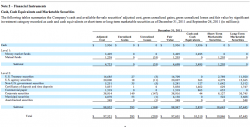

At the end of the last quarter Apple had approx. $67 billion in long-term securities; $20 billion in short-term securities; and a little over $10 billion in cash in the bank. Long-Term generally means Bonds with a maturity of greater than one year: ie. A US Government bond with a maturity date sometime in 2015. Short-term securities are those with a maturity less than 12 months from now: ie. GE 90-day commercial paper.

"Marketable Securities" is generally used to refer to commercial paper or Government bonds or notes that are said to be highly "liquid" - meaning that they can quickly be sold for cash, without losing a large portion of their value in the process.

By any reasonable definition, Apple could raise $100 billion in cash in a very short period of time, by selling its long- and short-term securities.

Marketable Securities does not refer to speculative investments in privately or publicly-traded equities.