Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Stock market briefly tanks, Apple temporarily under $200/share...

- Thread starter Unspeaked

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yes its obvious it will do that after a 1000 pt drop in the DOW... all courtesy of one company.

For anyone wanting to see details, go directly to trading sites, using widgets or apps to check it going to work much, servers are being hammered down in NYC

For anyone wanting to see details, go directly to trading sites, using widgets or apps to check it going to work much, servers are being hammered down in NYC

Yes its obvious it will do that after a 1000 pt drop in the DOW... all courtesy of one company.

Greece, Inc?

Greece, Inc?

More like Greece the country and a misprint in price per share of a company under the stock ticker of PG

More like Greece the country and a misprint in price per share of a company under the stock ticker of PG

That's still not confirmed but it would make sense - the news out of Europe has been bad all week, but not bad enough to hit the DOW by 1,000 points...

That's still not confirmed but it would make sense - the news out of Europe has been bad all week, but not bad enough to hit the DOW by 1,000 points...

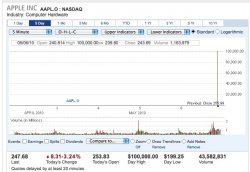

I'll pull a screen grab of it...

Edit: here ya go!

The Dow Jones industrials ($INDU) were down nearly 1,000 points at 9,869.62 at about 2:40 p.m. when they index suddenly rebounded. The loss was trimmed by more than half, but the blue chips still closed down 349 points, or 3.2%, to 10,520.

Link to article

Attachments

Here's something you don't see every day

Screen grab of CNBC aapl chart moments ago:

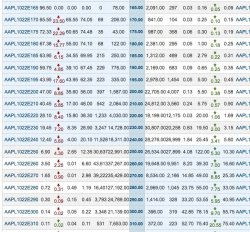

For some reason, financial sites are reporting Apple hit $100,000 today:

Open: 254.00

High: 100000.00

Low: 199.25

What happens when there are trade errors? Im sure many investors had automatic sell orders in place for stocks, funds, etc.

They all go through - that's what accelerated the drop: all the stop losses being triggered.

They all go through - that's what accelerated the drop: all the stop losses being triggered.

I meant now. I assume there will be some adjustment made?

They all go through - that's what accelerated the drop: all the stop losses being triggered.

Correct. Today was a good day to be a speculative intraday momentum trader.

It had to happen some day.

The market systems will literally reverse some of the more extreme trades as invalid. Good for the guy who bought AAPL at $100,000 and bad for the guy who bought a million shares of Proctor & Gamble at $0.01.

I suspect the guys who bought AAPL at $199 will get to enjoy it!

Rocketman

I meant now. I assume there will be some adjustment made?

No, they all go through. There's no second chances in the stock market.

CITI may have some recourse with the original PG typo, but Joe Average investor that had a $215 stop loss for his Apple shares is screwed.

Correct. Today was a good day to be a speculative intraday momentum trader.

It had to happen some day.

Look at the chart for PVR. A really solid NYSE company and today alone it almost spanned it's entire 52 week high/low!

What great news to wake up to! LOL...... Well at least it started to climb back up..... Let's hope it recovery's most if not all by early next week.

What great news to wake up to! LOL...... Well at least it started to climb back up..... Let's hope it recovery's most if not all by early next week.

This is the type of activity that presages a bear market (downward trend).

The prior March 2009 bottom was a liquidity crisis with a rapid V-shaped recovery. This one is more basic and real and caused by massive government spending and sucking activity from the private markets where real employment and growth comes from. Not to mention the governments running huge deficits and having unprecedented debt to revenue ratios.

Those factors changing will solve it, but that would require smart political action and last I checked that was an oxymoron. There would be a time lag.

If you own stock, "take profits" and employ practices to minimize risk. Put yourself in a cash position to buy amazing deals.

Rocketman

UPDATE: NASDAQ (the over the counter market AAPL trades on) canceled all trades more than 60% from the print at 2:40pm ET. As I suggested would happen.

UPDATE 2: NYSE ARCA canceled all trades between 2:40 and 3:00. That is unprecedented!

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.