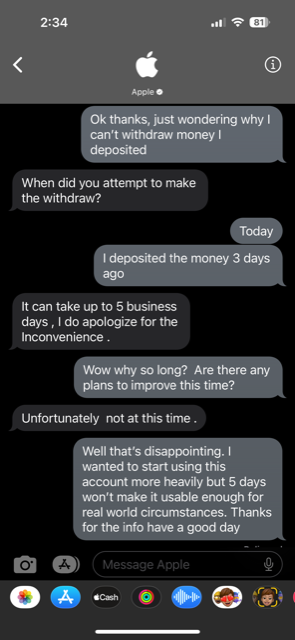

Just wanted to pass this information along to people here - I was hoping to take advantage of the very high interest rate for their Savings account, but you are unable to withdraw your money that you deposit for "up to 5 days"

I deposited $50 to test out the new feature 3 days ago and I still can't withdraw any of it.. it's like sitting in limbo. I see it as in the account, but when going to Withdraw, it wont let me touch it.

So heads up if you need to do a lot of quick turn around transactions of any kind. Pretty disappointing

I deposited $50 to test out the new feature 3 days ago and I still can't withdraw any of it.. it's like sitting in limbo. I see it as in the account, but when going to Withdraw, it wont let me touch it.

So heads up if you need to do a lot of quick turn around transactions of any kind. Pretty disappointing