In the end, your choice of investment is based on your goals and your tolerance for risk.

If you want a stable source of income, there are better investments than (most) stocks. Interest-bearing bonds and bank deposits, annuity contracts, and the like are likely to conserve your capital and pay you a promised return. One of the risks with this sort of investment is that the earnings received turns out to be lower than the inflation rate - your "safe," protected capital declines in value at a rate faster than it can be replenished by earnings.

One of the riskiest investments is starting your own business. The failure rate for new businesses is horrible, and while the reward for success can be enormous, often it's no better than earning the same (or lower) salary working for someone else. Basically, you're betting on yourself, and humans are pretty good at self-deception.

Stocks are investments in other peoples businesses. Rather than put all your money into a single business, you can diversify your risk by investing in a variety of businesses. You can buy highly speculative stocks that carry the lure of huge rewards if that (generally young) business becomes a success. You can also buy stocks in very well-established, stable businesses - lower risk, lower reward.

Young, rapidly growing companies are under little pressure to pay a dividend, as investors are already being rewarded by a higher stock price - all they need to do to cash in is to cash out. Mature, lower-growth businesses maintain their attractiveness by paying out part of their surplus cash as dividends, and/or using it to buy back shares (making the remaining shares worth more). Investors don't like it when a company is sitting on a huge pile of surplus cash that it refuses to share with its owners.

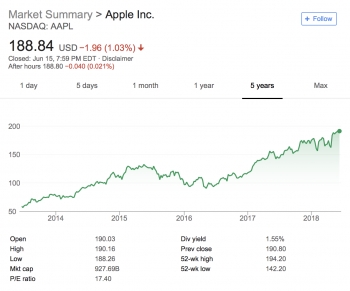

Apple has grown to the point where it can no longer attract investors with huge annual percentage gains in value. While some will argue that 15%-20% annual growth is still a very nice return, there are others who want more (sometimes much more) than that. Greed knows no bounds, so it's become time for Apple to "return money to shareholders."