Apple is once again planning to cut the interest rate of its Apple Card high-yield savings account, with the new rate set to go live on Friday, October 11.

The Apple Card savings account's annual percentage yield (APR) will drop to 4.10 percent, down from 4.25 percent. This is the third cut that Apple has made this year, and the second in the last few weeks.

Back in late September, Apple lowered the APY from 4.4 percent to 4.25 percent, and rates dropped from 4.5 percent to 4.4 percent in April.

At 4.10 percent, the Apple savings account APY will be below 4.15 APY that it launched with back in April 2023. Savings account interest rates fluctuate with changes made by the Federal Reserve, and when rates are lowered, banks cut their APYs. There was a notable rate cut of 50 basis points in September, and today, Federal Reserve policymakers suggested that more cuts are on the horizon.

Several other high-yield savings accounts from companies like Discover, American Express, and Capital One also now have a 4.10 APY.

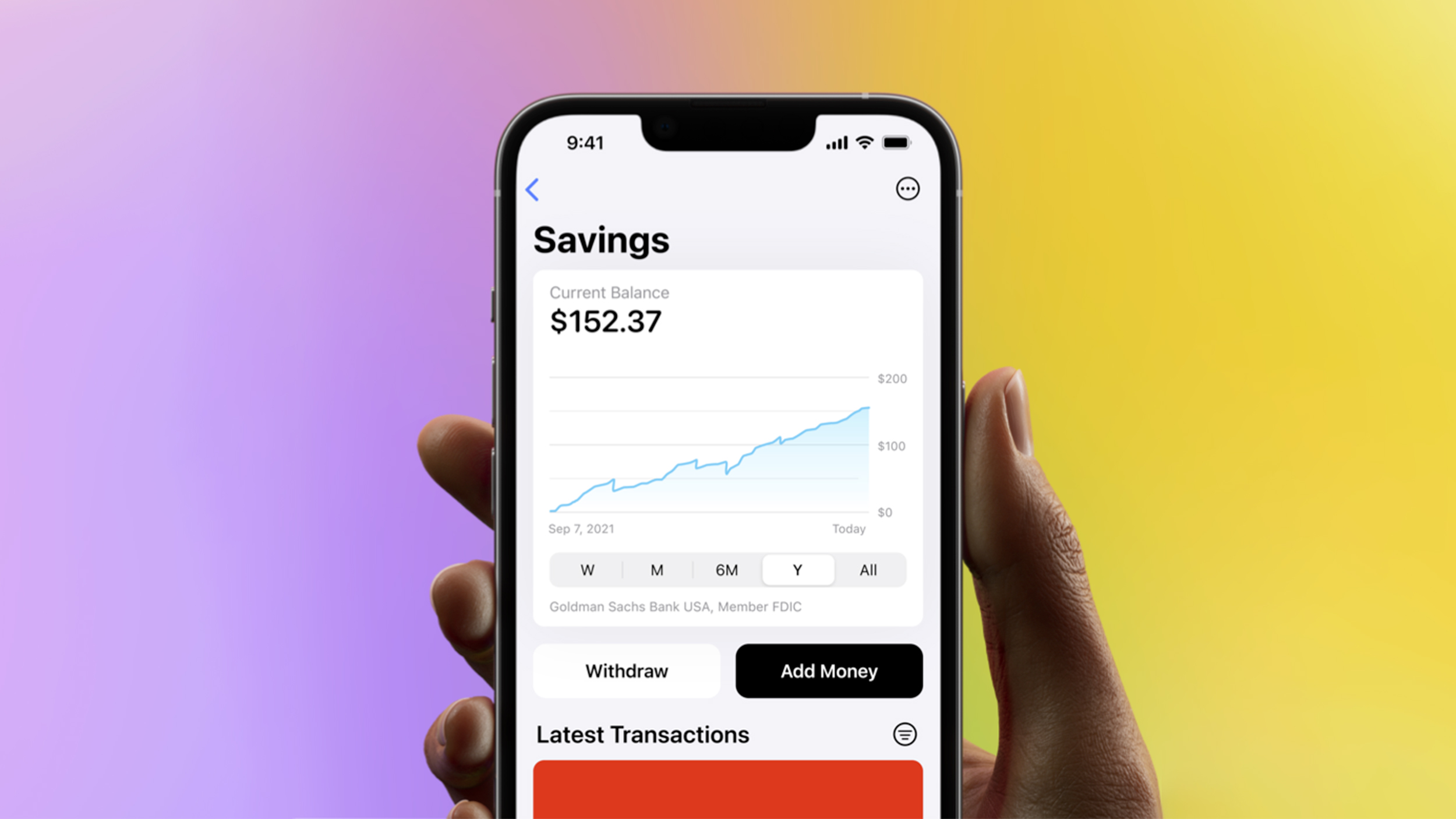

Apple partners with Goldman Sachs for the Apple savings account. It is available for Apple Card holders, and can be managed through the iPhone Wallet app much like the Apple Card. The Apple savings account is designed to allow Apple Card users to earn interest on their Daily Cash balance, and on funds transferred from bank accounts or Apple Cash balances.

Earlier this month, Apple decreased the Apple Card APR range, and it is now at 18.74 percent to 28.99 percent, down from 19.24 percent to 29.49 percent.

Article Link: Apple Card High-Yield Savings Account Getting Yet Another Interest Rate Cut