Most high end cards just convert to cash at purchase you pick the same seats as paying customers. The actual airline cards do this though and typically should be avoided.Meh...Nothing beats those airline credit cards with their "moderate" annual fees, limited number of reward seats available per flight, and the escalating number of miles required to redeem them for anything.

I don't know why anyone would even bother with an Apple Card, or any other credit card of that matter.😜

Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Highlights Apple Card Customer Satisfaction Ranking

- Thread starter MacRumors

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chase is still worth it the Sapphire Reserve with the Freedom can be over 6% back when redeemed for travel plus the lounge perks.I just avoid any card that gives miles. You can give me a bazillion miles and that still gives me no indication as to what I can do with them and the fine print that probably prevents me from doing what I want. I use 2 Bank of America cards that give a straight percent cash back. I get well over $1,000 back every year - simple.

I personally haven’t had any issues with my Apple Card but I have family members who do have serious issues as you’ve described and I know of the hours and hours they’ve had to spend on the phone just to get their own inexplicable errors corrected.They are awful IMHO. I have had so many issues with them. Billing errors etc. Theu are honestly the worst I’ve ever used. The tie in with iOS is nice. But Goldman needs to be babysat if you ever have to get something resolved even mildly complex.

It’s funny, the Apple Card phone support (Goldman sachs) likes to place the blame on Apple for programming the app with “errors” - I’m sure apple would not be too pleased that their partner is throwing them under the bus like that.

More cash back. What they currently offer is much less than many other cards. It’s not enough for me to use my Apple Card too often.

While they offer less it is instant and there are no hassles/limitations on how you can retrieve it. I much prefer this to the system of my old credit card where I had to spend $5000 before I could redeem $50.

Sir/Ma'am, you dropped your mic.J.D. Power specifically ranked ten of them in this catergoy but there are more.

View attachment 2247251

Milage may vary I had been traveling in Denver for work back in 2021 went to apple pay an air machine only to realize it was not functional (bad part of town). I chat with Apple Pay support and got my 1.95 back in a couple days. Yes I know its a small amount but it’s the principle.They are awful IMHO. I have had so many issues with them. Billing errors etc. Theu are honestly the worst I’ve ever used. The tie in with iOS is nice. But Goldman needs to be babysat if you ever have to get something resolved even mildly complex.

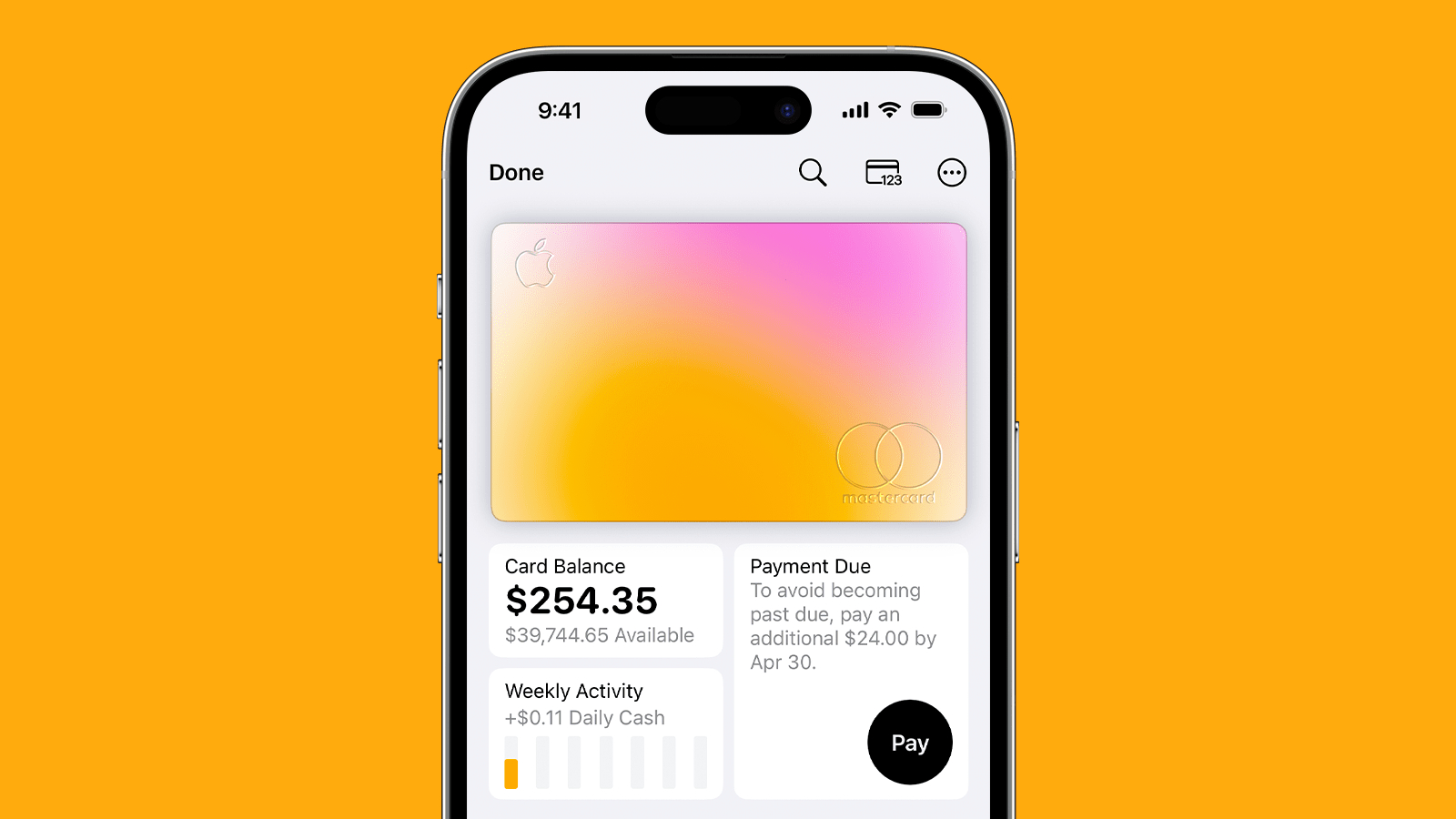

Whoa, the example graphic has a forty grand credit limit?

I'm going to say that is fake.I noticed that too. Makes me feel like it is time for a career change in the Game of Life.

$254.35 (card balance) + $39,744.65 (available credit) = $39,999.00, not $40,000.00

The photoshopper isn't good at math. 🤣

Wow...two people "disagree"Meh...Nothing beats those airline credit cards with their "moderate" annual fees, limited number of reward seats available per flight, and the escalating number of miles required to redeem them for anything.

I don't know why anyone would even bother with an Apple Card, or any other credit card of that matter.😜

...does that mean they didn't pick up on the sarcasm (despite the emoji)?

...or do they really like cards that offer airline miles?

I may have to take a break from MacRumors and enter a sarcasm-sensibility clinic.😟😟😟😟

Don't feel too bad, growing up in the 80s I discovered my Grandfather former VP of one of the twelve Federal Land Banks, in charge of the West Coast Credits, held a $500k credit card limit.I noticed that too. Makes me feel like it is time for a career change in the Game of Life.

That's... not much. I would think nowadays in order to live comfortably you should have min 50k in saving?Whoa, the example graphic has a forty grand credit limit?

I have an AC and a couple premium cards with high annual fees and see the hate AC gets by certain credit card snobs which makes no sense. If you live in a metropolitan area here in the US you can probably use Apple Pay at any establishment you can think of outside some sit down restaurants netting 2% cash back all day. There’s like two cards out there that have a flat rate 2% without an annual fee but outside of the AC they have weird rules about using the “cash back” forcing you to use it within the ecosystem (e.g. pay statement).

Additionally, credit card point systems are absolutely absurd, restrictive and confusing so the card snobs all promote artificial spending to hit a sub goal only to use the points for travel that will require you to spend more money on said card. That’s a vicious circle so unless you naturally spend thousands of dollars monthly it’s a waste for normal consumers and I would argue the easy cash back is worth more to me vs points which often don’t work out in your favor.

I’ll take the 2% cash back I can use as real money not the fake cash back with ecosystem limits or the archaic points system that simply encourages you to spend even more money.

Additionally, credit card point systems are absolutely absurd, restrictive and confusing so the card snobs all promote artificial spending to hit a sub goal only to use the points for travel that will require you to spend more money on said card. That’s a vicious circle so unless you naturally spend thousands of dollars monthly it’s a waste for normal consumers and I would argue the easy cash back is worth more to me vs points which often don’t work out in your favor.

I’ll take the 2% cash back I can use as real money not the fake cash back with ecosystem limits or the archaic points system that simply encourages you to spend even more money.

If you have a brokerage account with, say, Schwab or Fidelity it is pretty simple to get an Amex or Elan Visa credit card with at least 2% across the board cash back on all credit transactions. Pay the balance monthly and it is a no-brainer.I don't know why anyone would even bother with an Apple Card, or any other credit card of that matter.😜

I agree with many of the comments here. The card is fantastic, my payment of choice 100% of the time. But when they start to take away benefits like the SIM free financing, and changing the Apple Watch financing term from 24 months to 12 it makes it even less appealing. Hopefully when Goldman steps out of the picture and is take place by AMEX or another bank they start to offer the better features again

Apple Card is the "Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee" in the J.D. Power 2023 U.S. Credit Card Satisfaction Study, Apple announced today. This is the third year in a row that Apple and Goldman Sachs have taken the number one spot, and the third year that Apple has highlighted the study.

"Since the start, we've been committed to delivering tools and services that help users live healthier financial lives, and it's been rewarding to see customers using and finding value in the benefits of Apple Card. We are honored that Apple Card has been recognized as a leader in customer satisfaction," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "In partnership with Goldman Sachs, we are continuously working to expand the value users receive from Apple Card, most recently with the launch of Savings, and we look forward to continuing to develop tools and services that put our users and their financial health first."

The Apple Card earned a score of 655 on the J.D. Power scale, beating out the Hilton Honors American Express Card (638), the Amazon Prime Rewards Visa Signature Card (636), and the PayPal Cashback Mastercard (636).

This year's results come as rumors suggest that Goldman Sachs is looking to get out of its partnership with Apple. Goldman Sachs reportedly wants to exit consumer banking, and is seeking a partner that would take over its Apple Card and Apple Savings offerings. It is not yet clear if Goldman Sachs and Apple will be able to work out a deal to sever their relationship.

Article Link: Apple Highlights Apple Card Customer Satisfaction Ranking

That would bother me, too, but with Bank of American I think it only requires like $25 to redeem. So it's not an issue.While they offer less it is instant and there are no hassles/limitations on how you can retrieve it. I much prefer this to the system of my old credit card where I had to spend $5000 before I could redeem $50.

Oh god I HATE the ones where you have to book travel through their site. Usually pay more or it's limited in some inconvenient way. And I have never wanted an airport lounge. I want the food I want to get in the airport (I enjoy that part), not being limited to whatever limited free buffet (gross) food they offer. So yeah airport lounges are just a definite no appeal for me. I enjoy walking around airports anyway.Chase is still worth it the Sapphire Reserve with the Freedom can be over 6% back when redeemed for travel plus the lounge perks.

That's the credit limit, not the Apple Savings Account.That's... not much. I would think nowadays in order to live comfortably you should have min 50k in saving?

At that point you do hold a separate line of credit up with separate card and checks to it with around 10% and not CC.Don't feel too bad, growing up in the 80s I discovered my Grandfather former VP of one of the twelve Federal Land Banks, in charge of the West Coast Credits, held a $500k credit card limit.

I don’t use my Apple Card for any product related purchases because my AMEX SkyMiles Blue has supplemental coverages and the AC has none.

The AC is good if you use it with Apple Pay (2% rebate) for groceries outside of Costco it beats the Costco Visa by 1%.

The AC is good if you use it with Apple Pay (2% rebate) for groceries outside of Costco it beats the Costco Visa by 1%.

Last edited:

Wow thanks for pointing out 3 percent groceries with Apple pay.I don’t use my Apple Card for any product related purchases because my AMEX SkyMiles Blue has supplemental coverages and the AC has none.

The AC is good if you use it with Apple Pay (3% rebate) for groceries outside of Costco it beats the Costco Visa by 1%.

Another cards (chase) do 5% for 12 mos grocery, if you have flex rotating 5% grocery quarter, then it becomes 10%. If you do spend the points using sapphire card, you can get 1.25x multiplier, or 12.5% of total cash back which again can be spent on Apple store shopping with your points.

Wow thanks for pointing out 3 percent groceries with Apple pay.

Another cards (chase) do 5% for 12 mos grocery, if you have flex rotating 5% grocery quarter, then it becomes 10%. If you do spend the points using sapphire card, you can get 1.25x multiplier, or 12.5% of total cash back which again can be spent on Apple store shopping with your points.

Too much work.

That is why I am saying that 3% flat for tapping your phone is better than having 1.5% on another CC with the potential ability to get 12% (what if your grocery will not trigger increased % above 1.5%).Too much work.

Well, my Citibank AAdvantage credit card just got me American Airlines Executive Platinum through February 2025.

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.