Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

500,000 New Androids a Day!!

- Thread starter jimbo1mcm

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thought I read this. Apple kind of holds its cards close to the vest, but that figure HAS to be getting their attention. Sure it is over lots of forms, but that is a BIG number.

I'm almost 100% certain that that's not true. If it is I'd be amazed, that's an immense number. I know Android is getting big but that seems a bit steep.

Without a reputable source I would not believe it either.

The source is Google themselves at their earnings call yesterday.

http://techcrunch.com/2011/07/14/android-now-seeing-550000-activations-per-day/

Are they not reputable enough?

Last edited by a moderator:

Are they not reputable enough?

i guess they are. I stand corrected.

The source is Google themselves at their earnings call yesterday.

http://techcrunch.com/2011/07/14/android-now-seeing-550000-activations-per-day/

Are they not reputable enough?

Would that be new phones being activated? Or including reactivating 2nd hand phones? Never quite understood this.

Last edited by a moderator:

Would that be new phones being activated? Or including reactivating 2nd hand phones? Never quite understood this.

Not sure, but either way it is an impressive number, especially when compared with last year's Q2 results.

I was fortunate enough to be at the Formula 1 British Grand Prix this past weekend, along with about 100,000 others each day. By far the most common manufacturer of handset I saw in use there was HTC. Both Google and HTC are doing very well in the UK right now.

A lot of people I know use pay as you go, and I doubt many people want to pay the £510 it costs for iPhone when you can get a decent HTC Wildfire or Orange San Francisco for about £100.

A lot of people I know use pay as you go, and I doubt many people want to pay the £510 it costs for iPhone when you can get a decent HTC Wildfire or Orange San Francisco for about £100.

I was fortunate enough to be at the Formula 1 British Grand Prix this past weekend, along with about 100,000 others each day. By far the most common manufacturer of handset I saw in use there was HTC. Both Google and HTC are doing very well in the UK right now.

A lot of people I know use pay as you go, and I doubt many people want to pay the £510 it costs for iPhone when you can get a decent HTC Wildfire or Orange San Francisco for about £100.

You pretty much hit the nail on the head. And fact that Android is just as good as iOS (although it does come down to personal preference just like OS X vs Windows), makes the iPhone seem nothing but expensive.

Personally, I'm kinda annoyed I didn't get a HTC instead of an iPhone. Having played around with many Android based phones, I see no advantage in owning an iPhone. All it does is cost me more. For the iPhone I payed £99 for the handset and I'm now £30 a month for 24 months.

For a HTC phone with an OS which works just as good and the same sort of tariff, I would be paying a massive total of £0 for the handset and £15 a month. I'd be saving £460, which for me, a guy who is 18 years of age supporting his child, means a lot. Especially when there is no real advantage for paying it.

This is one of the cases where I'd wished I'd done some research before blindly buying. I like Apple products, but the iPhone seems just overpriced to me. I'm kinda annoyed I took out that contract now, however, what done is done and I do really like my iPhone despite having to pay through the nose for it.

Would that be new phones being activated? Or including reactivating 2nd hand phones? Never quite understood this.

It's the first activation of a phone or tablet that has Google services (usually built-in Maps, GMail, etc).

Most of those inexpensive Asian phones, tablets and other devices are not being counted, as they have no Google activation process.

So the real number being sold is higher by an unknown amount.

It's the first activation of a phone or tablet that has Google services (usually built-in Maps, GMail, etc).

Most of those inexpensive Asian phones, tablets and other devices are not being counted, as they have no Google activation process.

So the real number being sold is higher by an unknown amount.

I find it hard to believe that Google isn't reporting every Android phone in that number.

I find it hard to believe that Google isn't reporting every Android phone in that number.

There's no magic available to do that.

Google cannot know about a new device unless it goes through the Google activation and talks to Google.

That means that devices sitting in inventory also don't count towards the daily total.

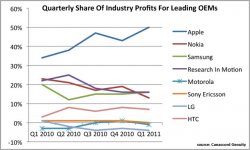

You know what's an even bigger number?

Apple's share of the smartphone industry profits.

That's a lot of phones though.

Exactly. I think Apple's main focus is on how much they make rather than how many phones they sell. Admittedly total profit is still linked to the number of phones sold but isn't dependent on being the biggest, more on making the most compelling product with high quality apps that people keep buying.

I found a couple of interesting articles about iOS and Android. I was going to start a new thread here but this one seemed appropreite.

http://www.tuaw.com/2011/04/27/four-android-myths-lazy-analysts-love/

I have quoted a few excepts. It is a fun read.

Here is a chart from another article.

http://static.intomobile.com/wp-content/uploads/2011/05/apple-profit-share.jpg

It really does not look like iOS has any worries right now.

http://www.tuaw.com/2011/04/27/four-android-myths-lazy-analysts-love/

I have quoted a few excepts. It is a fun read.

"What effect has Android's "ascendancy" had on Google so far? The first mass-market Android phone, the HTC Dream, was released on October 22, 2008. On that day, Google's stock was $355.67 per share, and its market cap at the beginning of September 2008 was $125.94 billion. Today, Google's stock is $525.10 per share, 148 percent more than before the first Android handset hit the market. That's a respectable increase, but nowhere near the massive rise in Apple's stock. Google's market cap now stands at $171.31 billion; Apple's market cap has grown by over $200 billion since it introduced the iPhone, but Google's has only grown by $45 billion since the first Android phone hit the market. Again, $45 billion is nothing to sneeze at, but it's sure not $200 billion... and since Google's only pulling in $1 billion in revenue per year from Android, it doesn't look like it's had much positive impact on Google's stock at all".

"Here's a couple of forehead-slapping "duh" points these guys are overlooking. First, "Android" isn't a company the way Google is a company. Android is a software platform, like Windows is a software platform. That leads into the second point: Google doesn't charge for Android like Microsoft charges for Windows. Google's profits from Android come from ad revenue, carrier licensing for Google-branded proprietary apps (Maps, Gmail, Market, etc.), Android Market fees and other sources -- but not sales of its smartphone OS. The people who really stand to make money off of Android are the smartphone vendors, and they're all competing not just with Apple, but with one another. Not to mention non-Android and non-iOS players like RIM and Windows Phone makers. And all the unsmart phones out there.

"Analysts like to treat Android like it's a single entity so that they can make impressive pie charts where Android looks like Pac-Man gobbling up iOS, but once you split that up by manufacturer, the story looks a lot different. It's virtually the same story as the PC market; Apple's share of the PC market looks trifling indeed when you compare it against Windows-running PCs as a whole, but when you break it down by each PC manufacturer, Apple definitely more than holds its own. When you break it down by profitability, the contest isn't even close; Apple owns 90 percent of the "high-end" PC market."

Here is a chart from another article.

http://static.intomobile.com/wp-content/uploads/2011/05/apple-profit-share.jpg

It really does not look like iOS has any worries right now.

Attachments

I think that the number (500,000) might be how many Android devices are being sold to carriers/outright. But not how many are actually being sold to customers.

Just a thought. From an Android user. Since 500,000 a day seems like a heck of a lot of phones. In a month, that's 15 million...

Just a thought. From an Android user. Since 500,000 a day seems like a heck of a lot of phones. In a month, that's 15 million...

Universal licensing + doing it early. When you don't care what your OS runs on the inevitable result is that your 500,000 activations include a lot of junk. In fact, it probably includes any phone made by anyone that has some sort of touchscreen tech on it.

Congratulations. It's like kissing your sister.

Google pulling an MS in the market is hardly impressive. Correction: it's very impressive in terms of sheer force of numbers. When you look at what's behind those numbers, however, things become a little too clear.

You want impressive? THIS is impressive:

http://allthingsd.com/20110510/analyst-apples-old-stuff-outsells-androids-new-stuff/

Why is it impressive? Because those who give a damn about what they put their name to don't license out their OS. And the results, of course, are obvious.

Google has done a great job of grabbing the "OEM"/commodity market by marketing iPhone alternatives well before anyone else tried. More power to them in that regard. We need a vendor like that. Apple won't deal with Wing-Chun's Chow Mein and Mobile's plastic junk phones, but someone has to in order to spread such devices (quality aside) to all the corners of our green earth.

The real loser in all this is MS, of course. Google's market could have just as easily been theirs. Once again, you can thank Ballmer's amazing prescience.

What the market *really* needs is another talented company with the same business model as Apple's. That's the way the market moves forward. Or you can depend on Apple to show the way entirely. It's worked so far. But it would be nice to have another Apple-esque mover and shaker.

Congratulations. It's like kissing your sister.

Google pulling an MS in the market is hardly impressive. Correction: it's very impressive in terms of sheer force of numbers. When you look at what's behind those numbers, however, things become a little too clear.

You want impressive? THIS is impressive:

http://allthingsd.com/20110510/analyst-apples-old-stuff-outsells-androids-new-stuff/

Why is it impressive? Because those who give a damn about what they put their name to don't license out their OS. And the results, of course, are obvious.

Google has done a great job of grabbing the "OEM"/commodity market by marketing iPhone alternatives well before anyone else tried. More power to them in that regard. We need a vendor like that. Apple won't deal with Wing-Chun's Chow Mein and Mobile's plastic junk phones, but someone has to in order to spread such devices (quality aside) to all the corners of our green earth.

The real loser in all this is MS, of course. Google's market could have just as easily been theirs. Once again, you can thank Ballmer's amazing prescience.

What the market *really* needs is another talented company with the same business model as Apple's. That's the way the market moves forward. Or you can depend on Apple to show the way entirely. It's worked so far. But it would be nice to have another Apple-esque mover and shaker.

Why not, it worked so well for Microsoft. 90% marketshare, profits through the roof. Why not emulate a process that worked so well.Google pulling an MS in the market is hardly impressive. Correction: it's very impressive in terms of sheer force of numbers. When you look at what's behind those numbers, however, things become a little too clear.

Why not, it worked so well for Microsoft.

Has it really?

Someone once asked me whether I'd like to see MS fail completely.

I told them I'd never wish for that, because they make Apple look so damn good without Apple having to really do anything.

Yes, MS has the old-school PeeCee market majority share . . . along with zero prestige and negative mindshare piled up so high that you need wings to stay above it. This is what happens when you license universally. You end up ruling the bargain-bin.

MS has been in decline for years. Largely because of their universal licensing racket. Thanks to their attention to that model they're absolutely lost in the markets that actually matter now.

So no, it hasn't worked well for them in the long term - not when they're embarrassed year after year by a smaller, leaner, more efficient rival whose R&D budget is but a mere fraction of MS'.

I'd rather have a high-end HTC phone (or even an MS phone) than an iPhone phone, but the iPhone still makes the money and is basically synonymous with smartphones amongst the masses.

Last edited:

Exceedingly well, look at their profits (in the billions) and stock price. Many CEOs would sell their souls to have what MS has, in terms of stock price, cash on hand, profits.Has it really?

Specifically what has declined with Microsoft?MS has been in decline for years. Largely because of their universal licensing racket. Thanks to their attention to that model they're absolutely lost in the markets that actually matter now.

Last edited:

Little risk, little reward

Desktop market share

Browser market share

Mobile market share

Share value

The entire company has been in decline under Ballmer. They're still making money, but from all the wrong things. And they'll be in for quite a surprise as a result. Making a lot of money is one thing, but where is that money coming from? That's the question.

MS can decide to invest in horse manure and make billions off it, but does that put an amazing tablet in your hands? Does that credit MS with revolutionizing the mobile industry in June 2007? Does that mean they're releasing the next big thing in consumer tech? Does it mean they've got the best mobile OS in the entire market? Does it make them relevant in all the markets that matter?

Is what MS is doing putting great things in your hands and pocket and not years after someone else already did it better? NO. That's for others to do, the ones who aren't absolutely befuddled from their laziness. And if it ever happens that you do get a me-too device from them that's worth having, it happens way too late. That's the point. MS is no longer a first mover, and when they do move they come up with something that was already eaten up and spat out by the competition years ago.

But they make a ton of money from Windows on PeeCee boxes and cheap little laptops. Still. Congratulations. How has it helped them? Where's all the money going? Coffee runs? New chairs?

After a decade, MS *still* only knows these three things:

1) How to create waste and redundancy

2) Windows on PeeCees

3) Office retreads

This stuff doesn't and won't cut it in today's market reality. MS needs to change, and change radically, and do it 4 years ago.

This is why many have been calling for Ballmer to GTFO. He should have been canned years ago. But hey, that Windows-licensing cash cow still makes money. So why take any risks?

Exceedingly well, look at their profits (in the billions) and stock price. Many CEOs would sell their souls to have what MS has, in terms of stick price, cash on hand, profits.

Specifically what has declined with Microsoft?

Desktop market share

Browser market share

Mobile market share

Share value

The entire company has been in decline under Ballmer. They're still making money, but from all the wrong things. And they'll be in for quite a surprise as a result. Making a lot of money is one thing, but where is that money coming from? That's the question.

MS can decide to invest in horse manure and make billions off it, but does that put an amazing tablet in your hands? Does that credit MS with revolutionizing the mobile industry in June 2007? Does that mean they're releasing the next big thing in consumer tech? Does it mean they've got the best mobile OS in the entire market? Does it make them relevant in all the markets that matter?

Is what MS is doing putting great things in your hands and pocket and not years after someone else already did it better? NO. That's for others to do, the ones who aren't absolutely befuddled from their laziness. And if it ever happens that you do get a me-too device from them that's worth having, it happens way too late. That's the point. MS is no longer a first mover, and when they do move they come up with something that was already eaten up and spat out by the competition years ago.

But they make a ton of money from Windows on PeeCee boxes and cheap little laptops. Still. Congratulations. How has it helped them? Where's all the money going? Coffee runs? New chairs?

After a decade, MS *still* only knows these three things:

1) How to create waste and redundancy

2) Windows on PeeCees

3) Office retreads

This stuff doesn't and won't cut it in today's market reality. MS needs to change, and change radically, and do it 4 years ago.

This is why many have been calling for Ballmer to GTFO. He should have been canned years ago. But hey, that Windows-licensing cash cow still makes money. So why take any risks?

Last edited:

In fact, it probably includes any phone made by anyone that has some sort of touchscreen tech on it.

I think that the number (500,000) might be how many Android devices are being sold to carriers/outright. But not how many are actually being sold to customers.

Nope to both ideas. See above. It's only devices with Google services that have been bought and gone through the initial Google activation process.

Just a thought. From an Android user. Since 500,000 a day seems like a heck of a lot of phones. In a month, that's 15 million...

It's also tablets, but probably 95% or more are phones. Not just because phones sell more, but because a huge number of tablets don't come with Google services and thus are not being counted.

As for being a lot, it's still rising. There are predictions that it'll be a million a day by early next year.

Has it really?

Someone once asked me whether I'd like to see MS fail completely.

I told them I'd never wish for that, because they make Apple look so damn good without Apple having to really do anything.

Yes, MS has the old-school PeeCee market majority share . . . along with zero prestige and negative mindshare piled up so high that you need wings to stay above it. This is what happens when you license universally. You end up ruling the bargain-bin.

MS has been in decline for years. Largely because of their universal licensing racket. Thanks to their attention to that model they're absolutely lost in the markets that actually matter now.

So no, it hasn't worked well for them in the long term - not when they're embarrassed year after year by a smaller, leaner, more efficient rival whose R&D budget is but a mere fraction of MS'.

A recent story mentioned on Tech New Today talked about how Microsoft has 88 percent of the operating system market. That's not too shabby and indicates that Microsoft isn't going to fade away any time soon.

And I am not sure how "zero prestige and negative mindshare" relates to anything that you find on a company's financial statement.

And I am not sure how "zero prestige and negative mindshare" relates to anything that you find on a company's financial statement.

Until you look behind the numbers, they're all just numbers on a financial statement.

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.