With emphasis I was pointing out where the SoC R&D money is coming from. Macs would not have the revenue to self support their own SoC R&D with how unpopular they are relative to AMD/Intel.And the chart is misleading because it uses a quarter where Mac sales are unusually low relative to the rest of the company. Nowhere in your answer do I see an acknowledgement of that. When I get it wrong here on the site, I ackowledge it, and thank the poster for the correction. Why don't you?

Without the iPhone, Macs would still be stuck on 14nm Intel and Intel would still be at 14nm until now as no monopoly has any incentive to innovate.

Why are you so hung up on the the chart anyways? Does it say that Macs are as lucrative as iPhones? Is the variation that large to make it that wrong?

Or is my sample size too small for your standards?

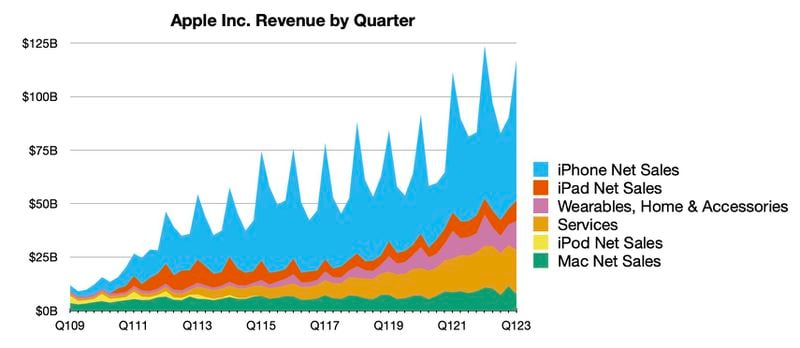

I was thinking of using this chart below but visually I personally find it a bit busy, messy and unclean. Unlike a simple pie chart But then again the green of the "Mac Net Sales" is largely flat compared to other product/service lines.

When Gates was explaining the inapplicability of Moore's Law to cars, he was talking about year-over-year advances. That has nothing to do with my analogy, which is about the relative performance of the same tech in the same year used in different applications.

I think someone else answered your analogy succinctly.

Apple's chips are *so* efficient that, even with a quadratic or cubic increase in power with speed, they could implement a "turbo" boost for at least a few cores, giving significantly higher single-threaded performance in their desktop chips, while still having relatively low TDP. And that would be a big deal, since most apps today continue to be single-threaded. Hopefully they will do this with the M3.

I leave that design decision to Apple.