Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Pay Apple Pay in Germany

- Thread starter 4254126

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Looks like Nov 3rd)))Aaaaannd another Tuesday without Apple Pay in Germany. Is everybody here doing ok?

No way. Will never happen. Apple doesn't launch services Fr-Sun. Apple likes traditions, won't happenLooks like Nov 3rd)))

First (full) week of November is looking likely. I'm going to stop checking regularly now...

Still don’t get why they have announced it on last conference call when releasing after the next one.

Still don’t get why they have announced it on last conference call when releasing after the next one.

This might be cause of the competitors like Google Pay, Mobiles Bezahlen etc. They just do not want to lose customers cause of the payment market. I just read an article that implies customers will not change their Mobile OS if they switched once

The other explanation would be, that other Banks wanted to join after they announced it and Apple just postponed the release to get more Banks onboard at the launch

Still don’t get why they have announced it on last conference call when releasing after the next one.

This week is not over yet and there is still another week before the next earnings-call.

24th or the 25th of October are possible dates. (Source: https://de.wikipedia.org/wiki/Apple_Pay ) Take a look at the table.

AP is a never ending story...feels like "Täglich grüßt das Murmeltier"...This week is not over yet and there is still another week before the next earnings-call.

I don’t think that apple is postponing releases cause of competitors. It’s more the other way round.

And they will have already talked to all the banks in Germany. None of them got that surprised that they wanted to take part or made the decision to take part after apple announced it. And apple won't wait cause of a few banks changing their minds.

At least thats what i think. Apple is super strong and big and they play that role slot. They don’t even give a **** about their customers...

And they will have already talked to all the banks in Germany. None of them got that surprised that they wanted to take part or made the decision to take part after apple announced it. And apple won't wait cause of a few banks changing their minds.

At least thats what i think. Apple is super strong and big and they play that role slot. They don’t even give a **** about their customers...

The Sparkasse article brought me to some thoughts:

- why are there 100 Mill. Cards?

--> my answer: ever thought about that every bank account comes with a free card, as it is needed for cash withdrawal? So why do they judge these as potential payment cards?

- I believe that there are a lot of people that really only use that bank card very rarely for payment or never and only use it for cash or "Kontoauszüge". Sometimes for doing transactions at the bank terminals.

- people that have credit cards do mostly own them to also use them for payment and nearly never for other things (I know dkb and some other do it for cash, but that's sometimes not the main purpose?

- in other countries the credit card is often used also for regular payments (telephone bill, insurances, etc.) that's why their transaction numbers are also higher, we do this with Lastschrift as stated in the article. So really some things to think about.

So I don't see the potential for giro something like 100 Mill. Vs. 15 Mill credit cards, it's somehow lower?

Any comments on my thought?

- why are there 100 Mill. Cards?

--> my answer: ever thought about that every bank account comes with a free card, as it is needed for cash withdrawal? So why do they judge these as potential payment cards?

- I believe that there are a lot of people that really only use that bank card very rarely for payment or never and only use it for cash or "Kontoauszüge". Sometimes for doing transactions at the bank terminals.

- people that have credit cards do mostly own them to also use them for payment and nearly never for other things (I know dkb and some other do it for cash, but that's sometimes not the main purpose?

- in other countries the credit card is often used also for regular payments (telephone bill, insurances, etc.) that's why their transaction numbers are also higher, we do this with Lastschrift as stated in the article. So really some things to think about.

So I don't see the potential for giro something like 100 Mill. Vs. 15 Mill credit cards, it's somehow lower?

Any comments on my thought?

If you look at the payment method at POS, 70% of transactions are still cash based. In some way we could directly transfer this statistic to the Girocard and it’s potential as a payment method – it would mean there are probably somewhere around 30-45 Million potential cards.The Sparkasse article brought me to some thoughts:

- why are there 100 Mill. Cards?

--> my answer: ever thought about that every bank account comes with a free card, as it is needed for cash withdrawal? So why do they judge these as potential payment cards?

- I believe that there are a lot of people that really only use that bank card very rarely for payment or never and only use it for cash or "Kontoauszüge". Sometimes for doing transactions at the bank terminals.

- people that have credit cards do mostly own them to also use them for payment and nearly never for other things (I know dkb and some other do it for cash, but that's sometimes not the main purpose?

- in other countries the credit card is often used also for regular payments (telephone bill, insurances, etc.) that's why their transaction numbers are also higher, we do this with Lastschrift as stated in the article. So really some things to think about.

So I don't see the potential for giro something like 100 Mill. Vs. 15 Mill credit cards, it's somehow lower?

Any comments on my thought?

Just having a card someone is not using atm won’t make them use it later. Maybe there are that many cards but I don’t think there is a real potential to male ppl make more use of those cards. Ppl not using cards for payment (in my opinion) are ppl who don’t really trust that newish tech stuff and will prefer paying for an account at Sparkasse and want someone to talk to and want to know that guy. But tbh those customers will be dead in 15-30 years

Nope. There are 100 mio potential payment cards. These cards are in the market. They don’t have to geht there.If you look at the payment method at POS, 70% of transactions are still cash based. In some way we could directly transfer this statistic to the Girocard and it’s potential as a payment method – it would mean there are probably somewhere around 30-45 Million potential cards.

But from this 100 mio potential payment cards are just about x mio are being used on a regular day to day basis.

On the other hand the 15 mio CC aren‘t either used at local stores. Many of them are there for booking hotels, flights or payments in other countries but not at the local groceries. They are often even not in the wallet but in some drawers at home.

I’d love to use my cc more often, but most small businesses take ec only. Even in my city where we have a strong American military community. Terminals print out „Karte nicht lesbar“.

Another example was an italian restaurant with a sticker saying that they even accept Apple Pay and Google Pay, but when I attempted to buy with my MasterCard he responds with: „Karte erst ab 10€“.

Another example was an italian restaurant with a sticker saying that they even accept Apple Pay and Google Pay, but when I attempted to buy with my MasterCard he responds with: „Karte erst ab 10€“.

That’s true. We have 2 giro cards (mine is never used). And we have 4 Credit cards (2x ing visa, N26 and Amex). My wife is never using her Visa card (dunno y) and the N26 card I just carry around. I am using my Amex when possible and Visa is backup. But my curve card is on its way.

Offtopic: how long did the curve needed to be delivered after being manufactured?

[doublepost=1540318850][/doublepost]

Offtopic: how long did the curve needed to be delivered after being manufactured?

[doublepost=1540318850][/doublepost]

We were on vacation last week in Ahlbeck and there were several restaurants and shop not even accepting cards in general. Not even ec-cardsI’d love to use my cc more often, but most small businesses take ec only. Even in my city where we have a strong American military community. Terminals print out ‚Karte nicht lesbar‘.

Another example was an italian restaurant with a sticker saying that they even accept Apple Pay and Google Pay, but when I attempted to buy with my MasterCard he responds with: ‚Karte erst ab 10€‚

I hope by "später in diesem Jahr" they mean directly with the launch.Comdirect now officially communicating the support of Apple Pay, using the same standard Apple-PR-statement

I think they’ve been sure they’re going to be a launch partner ever since AP got announced , but they didn’t want to publicly announce it to confuse the other two major direct banks (ING and DKB) which both won’t offer it.

Had they it announced back in July, maybe DKB and ING would’ve jumped on the launch train as well. This way, they have one more thing they can market as a plus compared to other direct banks.

Had they it announced back in July, maybe DKB and ING would’ve jumped on the launch train as well. This way, they have one more thing they can market as a plus compared to other direct banks.

That’s true. We have 2 giro cards (mine is never used). And we have 4 Credit cards (2x ing visa, N26 and Amex). My wife is never using her Visa card (dunno y) and the N26 card I just carry around. I am using my Amex when possible and Visa is backup. But my curve card is on its way.

Offtopic: how long did the curve needed to be delivered after being manufactured?

[doublepost=1540318850][/doublepost]

We were on vacation last week in Ahlbeck and there were several restaurants and shop not even accepting cards in general. Not even ec-cards

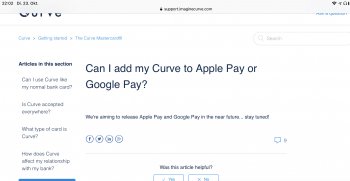

referring to curve credit card:

Curve is not working with Apple Pay ( until now )

Attachments

I do think so. The 25th is the dayYou’re saying we knew about this Data Protection Keynote 3 weeks ago and nobody used it as an argument for betting on the 25th of October?

I’m now more than sure, that we’ll get AP activated this week.

I do think so. The 25th is the day

Last edited:

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.