Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Pay Apple Pay in the UK

- Thread starter RDowson

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I'm travelling to the UK shortly. Is there still a limit of about 30 pounds at most places?

I like the ability to use Apple Pay to avoid giving my credit card number to multiple outlets when travelling, but with such a low limit I still need to carry a card and wallet. It kind of feels like living in the past when I leave home to be brutally honest.

I like the ability to use Apple Pay to avoid giving my credit card number to multiple outlets when travelling, but with such a low limit I still need to carry a card and wallet. It kind of feels like living in the past when I leave home to be brutally honest.

I'm travelling to the UK shortly. Is there still a limit of about 30 pounds at most places?

I like the ability to use Apple Pay to avoid giving my credit card number to multiple outlets when travelling, but with such a low limit I still need to carry a card and wallet. It kind of feels like living in the past when I leave home to be brutally honest.

Depends on the merchant. Most restaurants I've found will go over £30, only a few retailers I've found do.

Depends on the merchant. Most restaurants I've found will go over £30, only a few retailers I've found do.

Thanks, so I'll still carry a wallet.

Where do you live?I'm travelling to the UK shortly. Is there still a limit of about 30 pounds at most places?

I like the ability to use Apple Pay to avoid giving my credit card number to multiple outlets when travelling, but with such a low limit I still need to carry a card and wallet. It kind of feels like living in the past when I leave home to be brutally honest.

On regular work days I don’t carry my debit card because even with the £30 limit that’s enough to buy lunch, few supermarket things, pharmacy stuff, etc

But if I know I’m going to spend more than £30 I take my card with me.

It would be nice if one day my phone is my wallet as promised but there is one thing the plastic debit card can do that Apple Pay can’t, which was useful in IKEA the other day when their payment system went down.

Both the plastic card and Apple Pay can do online and offline transactions but the plastic card can also self authorise with the PIN. You know when one of these transactions happens because you’re also asked to sign at the end and if you log into your bank app it doesn’t appear as an authorised transaction. Kind of like a cheque book.

But if I know I’m going to spend more than £30 I take my card with me.

It would be nice if one day my phone is my wallet as promised but there is one thing the plastic debit card can do that Apple Pay can’t, which was useful in IKEA the other day when their payment system went down.

Both the plastic card and Apple Pay can do online and offline transactions but the plastic card can also self authorise with the PIN. You know when one of these transactions happens because you’re also asked to sign at the end and if you log into your bank app it doesn’t appear as an authorised transaction. Kind of like a cheque book.

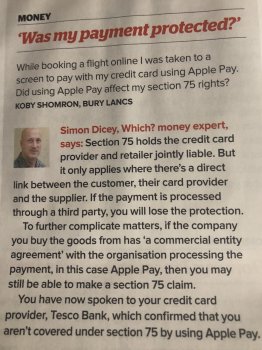

A bit concerning to see in Which magazine this month that Section 75 protection may not apply to purchases made with Apple Pay.

I was aware using PayPal could break the direct relationship between all parties required to guarantee protection. I didn’t ever consider it might be the same with Apple Pay, indeed this goes against articles at time of launch which specifically said S75 would be unaffected.

Anyone looked into this further?

I was aware using PayPal could break the direct relationship between all parties required to guarantee protection. I didn’t ever consider it might be the same with Apple Pay, indeed this goes against articles at time of launch which specifically said S75 would be unaffected.

Anyone looked into this further?

Attachments

A bit concerning to see in Which magazine this month that Section 75 protection may not apply to purchases made with Apple Pay.

I was aware using PayPal could break the direct relationship between all parties required to guarantee protection. I didn’t ever consider it might be the same with Apple Pay, indeed this goes against articles at time of launch which specifically said S75 would be unaffected.

Anyone looked into this further?

I'm not sure if that's correct as Apple Pay is essentially storing card details in a hashed state which you can then pay with. It's technically just like having a second card to an account and being able to pay contactlessly with it which would suggest to me it's still a direct relationship. This is unlike Paypal who definitely act as a middle-man and even offer their own guarantees as part of the service.

http://uk.creditcards.com/guides/what-is-apple-pay.php - S75 mentioned here

https://forums.moneysavingexpert.com/showthread.php?t=5258143 - interesting thread here on it too

I'm not sure if that's correct as Apple Pay is essentially storing card details in a hashed state which you can then pay with. It's technically just like having a second card to an account and being able to pay contactlessly with it which would suggest to me it's still a direct relationship. This is unlike Paypal who definitely act as a middle-man and even offer their own guarantees as part of the service.

http://uk.creditcards.com/guides/what-is-apple-pay.php - S75 mentioned here

https://forums.moneysavingexpert.com/showthread.php?t=5258143 - interesting thread here on it too

I agree. This is certainly the view I’ve had from day one. I remember reading both of these sources previously.

Hopefully just misinformation from a Tesco Bank employee but I plan to contact them and Which for clarification.

Is someone having problem paying with Apple Pay in UK, I've got most recent beta ios, and recently notice I've got probems with payments.. as when card reader says insert/touch card, I'm puting my phone (7+) over the card reader, apple pay screen showing up with my card, im touching ID, circle spins and then got hold near card reader/device something like that, few tries and no luck have to use a bank card instead.

Is someone having problem paying with Apple Pay in UK, I've got most recent beta ios, and recently notice I've got probems with payments.. as when card reader says insert/touch card, I'm puting my phone (7+) over the card reader, apple pay screen showing up with my card, im touching ID, circle spins and then got hold near card reader/device something like that, few tries and no luck have to use a bank card instead.

ApplePay hasn’t failed on me in years, and I use it for almost every transaction.

I've had an issue with Apple Pay whilst using the Beta programme in the past; was using the London Underground and it refused to let me enter the gate even though I'd armed my phone ready and was showing the 'tap to pay' animation.

Luckily it wasn't a busy station so I could stand to one side and perform a soft reset; dread to think what chaos I would've caused had it been St. Paul's around 5pm at night, haha!

I assume you've reported the issue using the Feedback app?

Luckily it wasn't a busy station so I could stand to one side and perform a soft reset; dread to think what chaos I would've caused had it been St. Paul's around 5pm at night, haha!

I assume you've reported the issue using the Feedback app?

Well it's been mentioned on here before that it's being trialled in a number of stores but Tesco are getting set to ditch the £30 Apple Pay limit:

https://www.moneysavingexpert.com/n...t-rid-of-p30-limit-on-apple-pay-transactions/

https://www.moneysavingexpert.com/n...t-rid-of-p30-limit-on-apple-pay-transactions/

About time! This is fantastic news. Asda need to follow suit.Well it's been mentioned on here before that it's being trialled in a number of stores but Tesco are getting set to ditch the £30 Apple Pay limit:

https://www.moneysavingexpert.com/n...t-rid-of-p30-limit-on-apple-pay-transactions/

About time! This is fantastic news. Asda need to follow suit.

Hope it’ll be at their pay@pump too!

All we need now, in terms of Tesco, is Automatic Selection when using a Clubcard... fingers crossed when higher value payments are nationwide they update the app to do so.

All we need now, in terms of Tesco, is Automatic Selection when using a Clubcard... fingers crossed when higher value payments are nationwide they update the app to do so.

What would that mean exactly?

What would that mean exactly?

Gotta Be Mobile explain it much easier than I ever could here:

https://www.google.co.uk/url?sa=i&s...aw0qnAlHiI3XRSGclh6i8Pcy&ust=1545261125555467

I received an email from Barclay Card a few days ago, reminding me that Apple Pay transactions on my Barclays Credit card are not limited to £30… I haven't tested that yet.

The bank,perhaps, does not limit the payments to £30, but some shops do.I received an email from Barclay Card a few days ago, reminding me that Apple Pay transactions on my Barclays Credit card are not limited to £30… I haven't tested that yet.

Even though your bank does not limit it, somewhere like Tesco still does

I received an email from Barclay Card a few days ago, reminding me that Apple Pay transactions on my Barclays Credit card are not limited to £30… I haven't tested that yet.

Got the same email. Although its down to the retailer to also accept touch payments over £30.

Shame - I wanted to get my £10 cashback on the Barclaycard! (current offer - spend over £30 using Apple Pay and you get £10 cashback)

I received an email from Barclay Card a few days ago, reminding me that Apple Pay transactions on my Barclays Credit card are not limited to £30… I haven't tested that yet.

The bank,perhaps, does not limit the payments to £30, but some shops do.

Even though your bank does not limit it, somewhere like Tesco still does

Got the same email. Although its down to the retailer to also accept touch payments over £30.

Shame - I wanted to get my £10 cashback on the Barclaycard! (current offer - spend over £30 using Apple Pay and you get £10 cashback)

I’ve noticed that often some of my transactions get declined even when they’re well under £30. Possibly because the merchant is not as well known or something?! ¯\_(ツ)_/¯

Got a £19.50 transaction declined literally on Saturday.

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.