I'm definitely not renewing music once my current trial expires. It was barely justifiable at 9.99. I cancelled ATV+ after we had it for a year for free and then paid for maybe another year or so without actually watching anything on it lol. I might sign up for a trial or a month here and there to catch up on some of the better shows they have but definitely won't be a keeper.

Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Increasing Pricing of Apple Music, Apple TV+, and Apple One

- Thread starter MacRumors

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HobeSoundDarryl

macrumors G5

supply shortage = people buy at any price = inflation. literally proving my point.

demand shortage = people saying no = falling prices.

There is literally no supply shortage for digital goods.supply shortage = people buy at any price = inflation. literally proving my point.

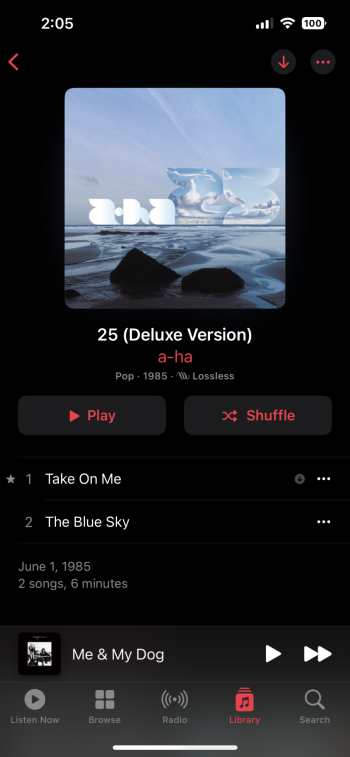

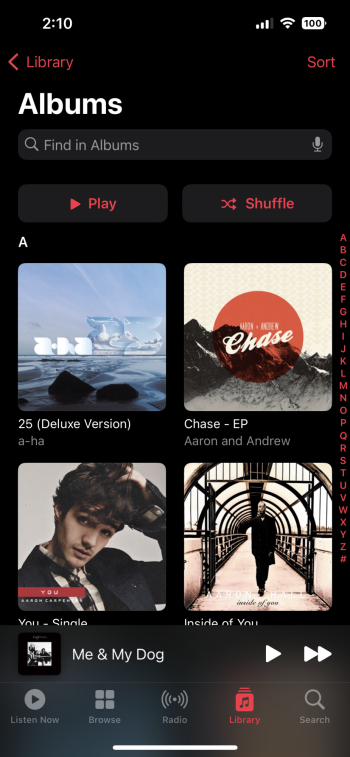

I think this is already possible if you add just the songs you want by swiping left on the song and tapping +. But maybe I’m misunderstanding what your goal is. Can you clarify?can’t add an album to the library without also adding all the songs on it to the library too).

In my case, I have two songs from the album pictured but the album itself shows in the Albums list but presents only my two chosen songs until I choose the “Show Complete Album” link and the other songs are shown but are not added to my Library.

What is happening in your case?

Attachments

True so why do people preorder digital video games?There is literally no supply shortage for digital goods.

Are they able to do that for existing customers in the UK?Carriers may up the price of the plan.

I used to work for Verizon Wireless and the way it worked was you could remain grandfathered in to no longer offered plans/pricing/features but as soon as you make some change to your service, they can require you to move to the new plans/pricing, so customers with excellent deals will insist on not making any changes when they call in except for contact and payment details, etc.

Because “they have enough money”.Why is Apple required to subsidize consumer purchases?

The same argument used by a kid that doesn’t want to go to school past HS, but still wants to have an extravagant vacation in some luxury spot. “BUT GUYSSSSSS, you already make WAY more than enough money to be able to pay for my vacation. So, there’s really no reason why you shouldn’t!!!”

Bonus/exclusive downloadable content has been the only incentive I’ve seen.True so why do people preorder digital video games?

Agreed. I think Ted Lasso is done after this upcoming season alsoAppleTV+ has a few great shows but I can go months without any of them having new episodes. I like Mythic Quest, Ted Lasso and The Morning Show and it feels like an eternity since any of them had a new episode. They need more good shows on there. It just doesn't have enough currently for 7 bucks a month.

I’m looking forward to Severance season 2 though. If I didn’t have Apple One I’d probably pause it when the series I’m watching is over like I do the other streaming services.

There is literally no supply shortage for digital goods.

you think there's no hardware involved in storing cat photos in iCloud? engineers' rents + pays didn't go up? production of movies/shows didn't go up?

demand shortage = people saying no = falling prices.

and? i think you're not understanding this.

Wait, you repeatedly sign up for trials that you… then… don’t use? Everyone’s gotta have a hobby!Has anyone ever paid for Apple TV+? I'm on my seventh trial (or so) and never use it, because of the lack of content.

HobeSoundDarryl

macrumors G5

and? i think you're not understanding this.

And vice versa.

So you keep paying just any price that sellers ask and blame it on "inflation" and I'll pick & choose what I wish to buy, being sure to say NO to things that are priced too high in my opinion.

Through your lens, paying any price due to "inflation" apparently makes perfect sense.

Through my lens, NOT paying any price due to "inflation" makes perfect sense.

If I'm the ONLY person that takes "inflation" on my way, prices will only continue to rise because the crowd goes at it like you do and accepts "inflation" as the reason they are paying any price. However, if many start going at "inflation" as I am, perhaps the sellers will desire our revenue too even if it means they must get prices down to levels to make us interested in buying again.

Looking through THIS thread of Apple enthusiasts who often joke about having to sell a kidney to afford the new <whatever> from Apple, I see good numbers deciding this this relatively smallish hike is not acceptable. If enough decide the same (and actually vote with their wallet), maybe Apple will reconsider... as countless other sellers have throughout history when they jacked their prices just too high and lost too many buyers to wash it in greater profit per (fewer) buyers.

Probably gets it with device upgrades/purchases.Wait, you repeatedly sign up for trials that you… then… don’t use? Everyone’s gotta have a hobby!

It is one per account though. Or at least it is supposed to be.Probably gets it with device upgrades/purchases.

Yea I got the message literally two days after I signed up for the free trial. Found my way to cancelling quicklyApparently they told The Verge that these accounts will be moved up to the current pricing from April

Might push me to try Spotify which, let's face it, is better than Apple Music. It's purely been an inconvenience issue for me not wanting port over all my playlists but if I now have a financial incentive for it too, I'll do it. I hope a lot of people follow suit and Apple's venture into the services business fails miserably because they suck at it. The only good service they have is Apple Card. Everything else is subpar to competition.

That's how it should work, but I have yet to see any prices droppingdemand shortage = people saying no = falling prices.

You keep writing inflation in quotes. Do you not think inflation is a real thing?And vice versa.

So you keep paying just any price that sellers ask and blame it on "inflation" and I'll pick & choose what I wish to buy, being sure to say NO to things that are priced too high in my opinion.

Through your lens, paying any price due to "inflation" apparently makes perfect sense.

Through my lens, NOT paying any price due to "inflation" makes perfect sense.

If I'm the ONLY person that takes "inflation" on my way, prices will only continue to rise because the crowd goes at it like you do and accepts "inflation" as the reason they are paying any price. However, if many start going at "inflation" as I am, perhaps the sellers will desire our revenue too even if it means they must get prices down to levels to make us interested in buying again.

Looking through THIS thread of Apple enthusiasts who often joke about having to sell a kidney to afford the new <whatever> from Apple, I see good numbers deciding this this relatively smallish hike is not acceptable. If enough decide the same (and actually vote with their wallet), maybe Apple will reconsider... as countless other sellers have throughout history when they jacked their prices just too high and lost too many buyers to wash it in greater profit per (fewer) buyers.

If the price increase goes toward rewriting Apple Music so it's actually a joy to use then no problem.

It is a joy to use, for me at least, and I'm sure a handful of others. I came from Spotify, and I can't believe I even bothered with Spotify in the first place and for as long as I did. Now AM can keep taking my money for as long as I live. It just works, so much better. AM has in fact 'learned' what I like to listen to and keeps delivering, day after day. This was something Spotify just couldn't seem to do properly for me.

HobeSoundDarryl

macrumors G5

That's how it should work, but I have yet to see any prices dropping

Because many/most people seem to just roll over and pay up any higher price. Some blame it on "inflation" now but it's been "supply chain issues", "war", "covid demands", etc recently. There's always plenty of reasons spun for RAISING prices vs. just saying we "want another record revenue quarter and can get away with charging more."

I strongly suspect the bulk of consumers have FORGOTTEN about the power of NO... the easy money, easy credit, easy payments, etc have trained us to find a way to buy anything we want or barely want... and we FORGOT to see our hard-earned money as just as valuable... just as desired by the sellers of the stuff.

So you won't see many prices dropping until people either re-learn to say NO or are forced there by price hikes going just too high where the masses are forced into saying NO. As soon as demand is pinched enough, prices will start falling to try to find a level to get us parting with dollars for stuff again. Until then- while the masses will pay anything- expect prices to simply roar higher and higher.

Only a few months ago, homes where I am were getting day 1 offers for full ask... even getting bid up above ask. Prices of homes are bid up to ridiculous levels here. With the cost of credit rising, payments for enormous mortgages are going up and thus demand is rapidly falling. Now it's taking much longer to get ONE offer and that offer is almost certainly going to be considerably BELOW ask.

What's happening? Do buyers not know about "Inflation! Inflation! Inflation!"

They know... but home demand has taken a big plunge and ask prices that were to-the-moon just a few months ago are now following the bids down trying to find LOWER levels where buyers will trade cash for homes again.

The same works for ANYTHING consumers buy... if enough decide that current pricing is too high for whatever it is.

Last edited:

And vice versa.

So you keep paying just any price that sellers ask and blame it on "inflation" and I'll pick & choose what I wish to buy, being sure to say NO to things that are priced too high in my opinion.

Through your lens, paying any price due to "inflation" apparently makes perfect sense.

Through my lens, NOT paying any price due to "inflation" makes perfect sense.

If I'm the ONLY person that takes "inflation" on my way, prices will only continue to rise because the crowd goes at it like you do and accepts "inflation" as the reason they are paying any price. However, if many start going at "inflation" as I am, perhaps the sellers will desire our revenue too even if it means they must get prices down to levels to make us interested in buying again.

There are no signs that people are willing to completely giving up premium streaming music on a large scale for the sake of protesting inflation prices. Tidal seems to be the only competitor that has not raised prices but we do not see a large scale of users flocking to Tidal (they recently lost subscriber numbers to Amazon Music). Rest of the industry has raised prices.

Regardless, you're starting to divert away from the initial assertion. This is due to inflation, period. You started arguing it's not inflation, but now you're arguing a way to get services to decrease prices which is not the debate at hand.

Sigh… I think I will cancel Apple One and move back to Music and iCloud+

I haven’t got an email about the price increase from Apple yet.

I haven’t got an email about the price increase from Apple yet.

Can they double my icloud space? Or let me add to it? Because it is a daily event trying to clear some… gotta love USING my 1TB ipad to store stuff. And then the family….

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.