They should just buy one of the virtual banks like Monzo or Starling.

Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Pay Apple Pay in the UK

- Thread starter RDowson

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thought we might have been in luck with Apple Pay Cash after today’s announcement but I guess we’re still going to have to be patient...

I had my fingers crossed, but no.. Apple obviously can't find a banking partner, which is odd seeing they have a good relationship with Barclays. It's a shame really, all my family would use Apple Pay Cash regularly.

Exactly what I was waiting for as well. Also Card is only in the USA. It’s a shame really.

In all fairness the interest rate is shocking.Exactly what I was waiting for as well. Also Card is only in the USA. It’s a shame really.

You shouldn’t be getting above 10% APR for a credit card unless you are new to finance or have a bad credit history.

In all fairness the interest rate is shocking.

You shouldn’t be getting above 10% APR for a credit card unless you are new to finance or have a bad credit history.

Yeah good point I think my Lloyds credit card is 6.45%. I was surprised at the APR on the Apple Card, although if you're paying off the full balance each month then it the APR really doesn't matter, seriously would like the new Apple Card in my wallet though...

[doublepost=1553601739][/doublepost]

They should just buy one of the virtual banks like Monzo or Starling.

I've had a Starling account for about a year it's only been recently I've moved from Lloyds and using Starling has been my main bank account, couldn't be happier. I would highly recommend them.

[doublepost=1553601773][/doublepost]

Exactly what I was waiting for as well. Also Card is only in the USA. It’s a shame really.

Just give us Apple Pay Cash and I'll be happy.

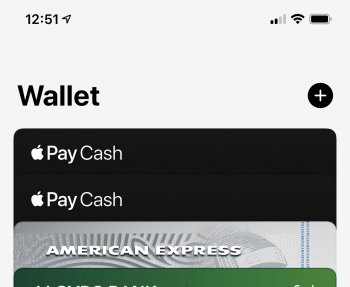

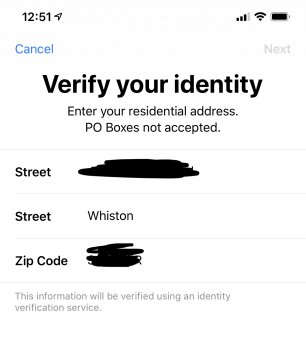

Anyone else in the UK started seeing the Apple Pay Cash card(s) today? I have two suddenly in my wallet, but when setting up it gets to the verify your identity and starts trying to verify my UK postcode as a US zip code so doesn't get any further... I updated iOS last night, and just checked and my iCloud account is set to UK...

[Edit]

So after looking in the settings I can turn it off and back on without issue - doing that set me back up with one card instead of the strange two. It's still trying to verify me as a US citizen though weirdly.

[Edit]

So after looking in the settings I can turn it off and back on without issue - doing that set me back up with one card instead of the strange two. It's still trying to verify me as a US citizen though weirdly.

Attachments

Last edited:

Anyone else in the UK started seeing the Apple Pay Cash card(s) today? I have two suddenly in my wallet, but when setting up it gets to the verify your identity and starts trying to verify my UK postcode as a US zip code so doesn't get any further... I updated iOS last night, and just checked and my iCloud account is set to UK...

[Edit]

So after looking in the settings I can turn it off and back on without issue - doing that set me back up with one card instead of the strange two. It's still trying to verify me as a US citizen though weirdly.

I’ve had it since iOS 11 around this time, last year, but you need a U.S. Address etc to set it up.

Tried again yesterday in the vain hope Apple might have surprised us; saw the Terms and Conditions as well as Fees screen.

Now I get an error message telling me it’s unavailable and to contact Apple Support.

In all fairness the interest rate is shocking.

You shouldn’t be getting above 10% APR for a credit card unless you are new to finance or have a bad credit history.

Yeah good point. I didn’t look at the APR at all to be honest.

Just give us Apple Pay Cash and I'll be happy.

I share your sentiment there.

In all fairness the interest rate is shocking.

You shouldn’t be getting above 10% APR for a credit card unless you are new to finance or have a bad credit history.

After some more research I found this. In case you’re interested.

https://apple.news/AEaT4jITWM3GfiTV1x-vv7A

I have a Starling account as well which I currently use for travelling, saving, and transferring money to friends.I've had a Starling account for about a year it's only been recently I've moved from Lloyds and using Starling has been my main bank account, couldn't be happier. I would highly recommend them.

I think in time I’ll start to use it as my main bank account.

A fair few of my friends have Monzo accounts and really like them, and Monzo are massively popular now, even gaining a fair amount of Middle Ages customers, which wasn’t their target audience.

[doublepost=1553735810][/doublepost]

That’s comparing cashback/rewards cards.After some more research I found this. In case you’re interested.

https://apple.news/AEaT4jITWM3GfiTV1x-vv7A

I stand by my statement, those with a decent credit history should not be looking at a credit card who charge over 10%.

For reference, Germany have a law which prevent any credit lender from providing anything over 40%. It is reasonable to expect someone with a decent or semi-decent credit to be able to get interest rates of below 10%.

I have a Starling account as well which I currently use for travelling, saving, and transferring money to friends.

I think in time I’ll start to use it as my main bank account.

A fair few of my friends have Monzo accounts and really like them, and Monzo are massively popular now, even gaining a fair amount of Middle Ages customers, which wasn’t their target audience.

[doublepost=1553735810][/doublepost]

That’s comparing cashback/rewards cards.

I stand by my statement, those with a decent credit history should not be looking at a credit card who charge over 10%.

For reference, Germany have a law which prevent any credit lender from providing anything over 40%. It is reasonable to expect someone with a decent or semi-decent credit to be able to get interest rates of below 10%.

Yeah I have a Monzo account as well, but much prefer Starling.

Originally got the account for traveling for when I was in the US and Canada last year. I saved a lot of money with the MasterCard exchange rate and of course no transaction and cash withdrawal fees. A few of my friends are now on board as well after all of them were so skeletal at first.

Starling has so many benefits, I think the rest of them are crazy for not opening an account and moving across. As you can tell I'm a massive fan.

Yeah I have a Monzo account as well, but much prefer Starling.

Originally got the account for traveling for when I was in the US and Canada last year. I saved a lot of money with the MasterCard exchange rate and of course no transaction and cash withdrawal fees. A few of my friends are now on board as well after all of them were so skeletal at first.

Starling has so many benefits, I think the rest of them are crazy for not opening an account and moving across. As you can tell I'm a massive fan.

Have you looked into curve?!

Have you looked into curve?!

Yeah I've got an account, but I've never really used it. It was back in the beta days, looks like things have come a long way since then.

I walked past my local Wilkos yesterday and noticed they had Apple Pay stickers in the window. When I tried last summer they had he £30 limit still in place. Does anyone know if they're unlimited now?

I feel your pain Paul, I hate it when a shop clearly displays the Apple Pay Logo (and Google Pay) but are limited to £30.

Don't bother advertising it then.

Had this at the weekend in "The Range" , clear Apple Pay logos shown but couldn't pay for a £42 transaction, so I made them ring it through twice as I had no other means of paying.

I then take to Twitter straight away and tweet my complaint to the companies.

Also had the problem with Wilco's before.

Don't bother advertising it then.

Had this at the weekend in "The Range" , clear Apple Pay logos shown but couldn't pay for a £42 transaction, so I made them ring it through twice as I had no other means of paying.

I then take to Twitter straight away and tweet my complaint to the companies.

Also had the problem with Wilco's before.

So I got a response from “the range”

Hi there,

Sorry for the delay in response.

I can advise that the sign for Apple Pay is on the till as this is an accepted payment method, and limit is set by your bank the same as contactless. Payments over the limited amount must be authorised by your bank.

Kind regards,

What a load of crap, they clearly don’t know what they’re talking about.

Hi there,

Sorry for the delay in response.

I can advise that the sign for Apple Pay is on the till as this is an accepted payment method, and limit is set by your bank the same as contactless. Payments over the limited amount must be authorised by your bank.

Kind regards,

What a load of crap, they clearly don’t know what they’re talking about.

So in other words "We don't have a clue what you're talking about so we'll just try to shift blame to someone else"

Playing devils advocate, given that when Apple Pay launched in the UK with like 20 partners, a monitory of whom actually accepted limitless Apple Pay at the time but still displayed the decals isn’t the range correct?

Apple Pay working anywhere contactless can be used is both a gift and a curse, but that’s surely better than the alternative (see: USA). If it worked differently this thread would probably be equally long but full of speculation and moaning like the Germany one.

Apple could solve this with new decals for those that take unlimited Apple Pay vs those that are merely contactless enabled.

Apple Pay working anywhere contactless can be used is both a gift and a curse, but that’s surely better than the alternative (see: USA). If it worked differently this thread would probably be equally long but full of speculation and moaning like the Germany one.

Apple could solve this with new decals for those that take unlimited Apple Pay vs those that are merely contactless enabled.

Coming from the UK but currently living in Germany I'm now actually baffled by how Apple Pay is far better und much less complicated here than back home. Just a few years ago credit cards were seen as the devils work here in Germany and not even large supermarket chains would take them. You were either seen as either a) a weird foreigner or b) "must be bankrupt". Others in the queue behind you would give you odd looks if you didn't pay by cash. That attitude has changed so much.

If you see a contactless terminal here, chances are close to 100% that you can just pay any sum with either Visa or MasterCard (Amex acceptance is still rather spotty). Sometimes you might come across stores that only accept the national German debit card system "Girocard", but apparently those cards will make it to Apple Pay in Germany this year. Thankfully contactless acceptance here has literally skyrocketed when in 2017 Aldi went from accepting only Debit cards to even taking Amex (all contactless). Deutsche Bahn has started installing contactless ticket machines across Germany and so on. All terminals I have come across have also got CDCVM implemented correctly, so that you don't hit any problems using Apple Pay (limit or having to enter a PIN number).

When I was back home visiting family by car a few months ago, I was left frustrated at a BP garage that refused to accept payment via Apple Pay as it was over £30. Thankfully I had a range of cards on me. It made me realise that this limit in the UK really limits your flexibility. Shopping at Tesco straight after caused further frustration...

Shows that if you're first to the (Apple Pay / NFC) party, it doesn't always have its advantages.

If you see a contactless terminal here, chances are close to 100% that you can just pay any sum with either Visa or MasterCard (Amex acceptance is still rather spotty). Sometimes you might come across stores that only accept the national German debit card system "Girocard", but apparently those cards will make it to Apple Pay in Germany this year. Thankfully contactless acceptance here has literally skyrocketed when in 2017 Aldi went from accepting only Debit cards to even taking Amex (all contactless). Deutsche Bahn has started installing contactless ticket machines across Germany and so on. All terminals I have come across have also got CDCVM implemented correctly, so that you don't hit any problems using Apple Pay (limit or having to enter a PIN number).

When I was back home visiting family by car a few months ago, I was left frustrated at a BP garage that refused to accept payment via Apple Pay as it was over £30. Thankfully I had a range of cards on me. It made me realise that this limit in the UK really limits your flexibility. Shopping at Tesco straight after caused further frustration...

Shows that if you're first to the (Apple Pay / NFC) party, it doesn't always have its advantages.

Coming from the UK but currently living in Germany I'm now actually baffled by how Apple Pay is far better und much less complicated here than back home. Just a few years ago credit cards were seen as the devils work here in Germany and not even large supermarket chains would take them. You were either seen as either a) a weird foreigner or b) "must be bankrupt". Others in the queue behind you would give you odd looks if you didn't pay by cash. That attitude has changed so much.

If you see a contactless terminal here, chances are close to 100% that you can just pay any sum with either Visa or MasterCard (Amex acceptance is still rather spotty). Sometimes you might come across stores that only accept the national German debit card system "Girocard", but apparently those cards will make it to Apple Pay in Germany this year. Thankfully contactless acceptance here has literally skyrocketed when in 2017 Aldi went from accepting only Debit cards to even taking Amex (all contactless). Deutsche Bahn has started installing contactless ticket machines across Germany and so on. All terminals I have come across have also got CDCVM implemented correctly, so that you don't hit any problems using Apple Pay (limit or having to enter a PIN number).

When I was back home visiting family by car a few months ago, I was left frustrated at a BP garage that refused to accept payment via Apple Pay as it was over £30. Thankfully I had a range of cards on me. It made me realise that this limit in the UK really limits your flexibility. Shopping at Tesco straight after caused further frustration...

Shows that if you're first to the (Apple Pay / NFC) party, it doesn't always have its advantages.

The limitation of payment is on the merchant really. They need to get their systems updated to the latest tech to accept any amount. With big chains that seems to be an issue given the cost involved.

The limitation of payment is on the merchant really. They need to get their systems updated to the latest tech to accept any amount. With big chains that seems to be an issue given the cost involved.

There isn't really any cost. All they need to do is implement CDCVM (customer device verification) in their terminals with a software update and they're good to go. Some (like Tesco) are using it as an excuse to push for their own payment solutions. Thankfully, Germany's contactless acceptance skyrocketed and the stores didn't have a chance to consider such options.

Tesco keep saying on Twitter that they’re trialing high value in select stores. Has anyone actually come across one of these stores or heard from anyone who has?

There isn't really any cost. All they need to do is implement CDCVM (customer device verification) in their terminals with a software update and they're good to go. Some (like Tesco) are using it as an excuse to push for their own payment solutions. Thankfully, Germany's contactless acceptance skyrocketed and the stores didn't have a chance to consider such options.

I understand what you mean but even a software update comes at a cost to such a huge scale retailer. Imagine the update messing up some of the stores for a couple of hours. They’ll lose out a lot of money. But yeah I understand what you mean, didn’t know Tesco had their own payment system?!

There isn't really any cost.

Who's going to apply the update? How long will it take? When will they do it? There absolutely is a cost, which could grow exponentially with the bigger retailers. Notwithstanding the potential for it to go wrong like @akash.nu said. Also, bigger retailers tend to have very tight integration between POS systems and payment terminals, which is good most of the time but a pain in the arse if anything needs to change.

I understand what you mean but even a software update comes at a cost to such a huge scale retailer. Imagine the update messing up some of the stores for a couple of hours. They’ll lose out a lot of money. But yeah I understand what you mean, didn’t know Tesco had their own payment system?!

I assume they are referring to Pay+. I’m not aware of any stores which are trialling higher value payments; could be Welwyn Garden City where our Head Office is?

so, another reply from "The Range"

"Hi there, I apologise for the delay in responding to you. I can advise that we as a company have chosen to keep this limit as many other retailers have, although no longer legally required, this is for the protection of our customers. "

So, I wrote back:

"I’m intrigued to know what protection “the range” are offering me by restricting Apple Pay, which in itself is far more secure than using a debit or credit card ?"

The Range

"We are offering the very physical protection of if someone loses their card and it is picked up, it can only be used up to the limit of £30 rather than an unlimited amount, hopefully allowing the owner of the lost card time to realise it is no longer in their posession. I hope this provides some clarification. "

So I wrote back

"That’s not how Apple Pay works. The contactless limit still stays at £30 at the card level, but Apple Pay allows limitless transactions via the iPhone or Apple Watch. You must know that. ???? It’s your terminals restricting things. Other retailers have upgraded their equipment to support it and Google Pay ie, M&S, subway, Lidl, Aldi, Costas, To name a few"

It's like banging your head against a wall when you talk to these people !!!

[doublepost=1554378475][/doublepost]And one last reply >

"Hi, As previously advised we have chosen as a business to leave the limit in place, as many other retailers, not including the list you have provided, have chosen to do."

"Hi there, I apologise for the delay in responding to you. I can advise that we as a company have chosen to keep this limit as many other retailers have, although no longer legally required, this is for the protection of our customers. "

So, I wrote back:

"I’m intrigued to know what protection “the range” are offering me by restricting Apple Pay, which in itself is far more secure than using a debit or credit card ?"

The Range

"We are offering the very physical protection of if someone loses their card and it is picked up, it can only be used up to the limit of £30 rather than an unlimited amount, hopefully allowing the owner of the lost card time to realise it is no longer in their posession. I hope this provides some clarification. "

So I wrote back

"That’s not how Apple Pay works. The contactless limit still stays at £30 at the card level, but Apple Pay allows limitless transactions via the iPhone or Apple Watch. You must know that. ???? It’s your terminals restricting things. Other retailers have upgraded their equipment to support it and Google Pay ie, M&S, subway, Lidl, Aldi, Costas, To name a few"

It's like banging your head against a wall when you talk to these people !!!

[doublepost=1554378475][/doublepost]And one last reply >

"Hi, As previously advised we have chosen as a business to leave the limit in place, as many other retailers, not including the list you have provided, have chosen to do."

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.