Got a tip for us?

Let us know

Become a MacRumors Supporter for $50/year with no ads, ability to filter front page stories, and private forums.

Apple Pay Apple Pay in Germany

- Thread starter 4254126

- Start date

- Sort by reaction score

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

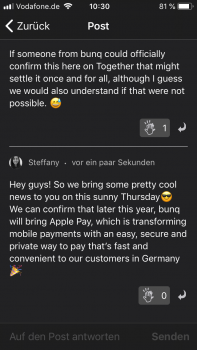

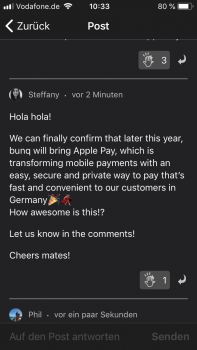

Yep, just got a tweet from them. Very, VERY happy about that! I hope we also get dual Maestro/MasterCard support...So bunq did confirm that they will launch Apple Pay as well. You can add them to the confirmed list.

Also funny they use the same wording as the German banks have... just you can tell it's the original source in English ;-)

We now have a statement on Twitter also directly from N26 (not just via CEO): https://twitter.com/n26/status/1024928827385020417

Yep, just got a tweet from them. Very, VERY happy about that! I hope we also get dual Maestro/MasterCard support...

Also funny they use the same wording as the German banks have... just you can tell it's the original source in English ;-)

bunq is a good point.... I'm examining the market and also looked up bunq and N26.

Can someone please explain, why these two banks are considered "cheap"? I think, they are rather expensive, if I compare the included services and want a comparable service scenario (for example including insurance provided by MC Gold) And N26 Metal is nearly daylight robbery...

A real serious question. What do I miss?

Well the regular account with N26 is free, so I don't see the problem there. Like with any bank, if you want insurance packages etc, you need to move up to a Premium (Black or Metal) tier.bunq is a good point.... I'm examining the market and also looked up bunq and N26.

Can someone please explain, why these two banks are considered "cheap"? I think, they are rather expensive, if I compare the included services and want a comparable service scenario (for example including insurance provided by MC Gold) And N26 Metal is nearly daylight robbery...

A real serious question. What do I miss?

bunq see themselves as a technology company first and don't invest any money or offer savings accounts etc. There is also a free account but you can pay to get 25 IBAN accounts, 3 cards of your choice and many other bits that aren't included in a regular account. They do that to cover the main part of their costs. It's just a different model and - thanks to a free market economy - you can pick and choose what you want!

jupp. as I said, compareable serives like insurance. and then it's getting rather expensive at N26.Well the regular account with N26 is free, so I don't see the problem there. Like with any bank, if you want insurance packages etc, you need to move up to a Premium (Black or Metal) tier.

Cost free accounts are there for over 20 years now. I don't get the N26 hype.

Jupp, I said that yesterdaybunq see themselves as a technology company first and don't invest any money or offer savings accounts etc. There is also a free account but you can pay to get 25 IBAN accounts, 3 cards of your choice and many other bits that aren't included in a regular account. They do that to cover the main part of their costs. It's just a different model and - thanks to a free market economy - you can pick and choose what you want!

I just wanted to know, if I'm missing something about these two banks what makes the hype understandable, as there are ongoing rants about other banks with cheaper account models.

So, there is nothing I miss.

Depends. The bunq app is second to none so far. Looking at some of the other rubbish banks have thrown on the market, it really is great. And from "later this year" adding to that: Apple Pay (incl. Maestro support!).So, there is nothing I miss.

but for 8€/MonthDepends. The bunq app is second to none so far. Looking at some of the other rubbish banks have thrown on the market, it really is great. And from "later this year" adding to that: Apple Pay (incl. Maestro support!).

I thought it through, if it would make sense to get the 25 virtual accounts ... for example to seperate money for different categories.

no statement so far. would GC not expect from Deutsche Bank.Is there any confirmation that the participating banks will let you add Girocards, or is this for credit cards only?

Just give it a try. You get a free month and it's "Schufa frei", so won't affect your credit score.Is there any confirmation that the participating banks will let you add Girocards, or is this for credit cards only?

@sir-hd : What's so great about the bunq app?

And my general suggestion would be to try different apps and banks out. Many offer demo accounts so you can play around with the apps and online banking beforehand. So once Apple Pay launches, I'll be switching my accounts accordingly - and I remember Barclays customers back in the UK switching away after it was clear they weren't going to support it. The pressure was too high and they joined a year later. Would love to know how many customers switched because of missing Apple Pay functionality. BTW I did the same back then

Last edited:

It looks like this is the standard phrase the banks are allowed to use right now:We now have a statement on Twitter also directly from N26 (not just via CEO): https://twitter.com/n26/status/1024928827385020417

Later this year, INSERT BANK NAME will bring Apple Pay, which is transforming mobile payments with an easy, secure and private way to pay that’s fast and convenient to customers in Germany.

noch in diesem Jahr wird die HypoVereinsbank Apple Pay auf den Markt bringen, das mobiles Bezahlen für Kunden in Deutschland sowohl schnell und bequem als auch einfach, sicher und vertraulich macht.

etc.Später in diesem Jahr wird die Hanseatic Bank Apple Pay auf den Markt bringen, das mobiles Bezahlen für Kunden in Deutschland sowohl schnell und bequem als auch einfach, sicher und vertraulich macht.

@docfred I have the same problem with bunq, i dont see the value for the 8€/month.

I get 3 cards, ok but all debit cards, which can give you problems when renting a car in US.

Getting more accounts: Means to me to look for more accounts that they are in balance so nothing drops and means a lot of changing IBANS for companys I order stuff from. 25 IBANS is just in my eyes a waste of accounts.

I do compare it with the DKB as that is my main account.

I was able to order an additional account with my wife very easily, we have cards for every account (I have 2 Visa+Giro for my account and my wife and I have each an additional visa and Giro for our combinated account), I dont pay any foreign fees anymore in the US (where i am usually once a year and that saved me already at least 50€!).

But OK, other people might have other thoughts about banking, its just my 2 cents about it

I get 3 cards, ok but all debit cards, which can give you problems when renting a car in US.

Getting more accounts: Means to me to look for more accounts that they are in balance so nothing drops and means a lot of changing IBANS for companys I order stuff from. 25 IBANS is just in my eyes a waste of accounts.

I do compare it with the DKB as that is my main account.

I was able to order an additional account with my wife very easily, we have cards for every account (I have 2 Visa+Giro for my account and my wife and I have each an additional visa and Giro for our combinated account), I dont pay any foreign fees anymore in the US (where i am usually once a year and that saved me already at least 50€!).

But OK, other people might have other thoughts about banking, its just my 2 cents about it

New statement from Ing-Diba (similar wording like the old one)

https://www.ing-diba.de/ueber-uns/wissenswert/zahlungsmethoden/

Hallo Zusammen, an dieser Stelle bedanken wir uns für die vielen Beiträge zu Apple Pay - wir haben jeden einzelnen Beitrag gelesen, können aber leider nicht jeden Kommentar individuell beantworten. Zurzeit planen wir nicht, Apple Pay in den nächsten Monaten anzubieten. Unseren Girokonto-Kunden ermöglichen wir bereits das kontaktlose Zahlen mit der VISA-Card, und wir wollen die Entwicklung nach Einführung der neuen Zahlungsmethode von Apple (auch Google) beobachten und analysieren. Die Entscheidung, ob wir Apple Pay unterstützen, erfolgt zu einem späteren Zeitpunkt. Viele Grüße, Ihr Social Media Team

https://www.ing-diba.de/ueber-uns/wissenswert/zahlungsmethoden/

Cost free accounts are there for over 20 years now. I don't get the N26 hype.

I just wanted to know, if I'm missing something about these two banks what makes the hype understandable, as there are ongoing rants about other banks with cheaper account models.

When N26 launched, the idea of mobile banking, where you can do everything in one app, was new.

- I also liked and still like that you get instant push notifications about all the transactions.

- You can lock your cards in the app. ("Damn, I think I lost my wallet." *locks card* instead of calling your bank and having to pay for a new card. Then: Oh there's my wallet: I forgot it in the car. *unlocks card*)

- You can change your PIN in the app.

- You can change your daily limits in real time. Helpful when you travel sketchy places.

- No foreign currency fees. (There are now fees for foreign ATM withdrawls which I don't like)

One bug (?) is annoying as hell: reoccurring transactions don't remember the label/tag/category that I gave them before. Auto-labeling works sometimes.

For my use-case I don't see the advance of bunq. I pay 8€ a month for 25 IBANs that I won't need and a nice app. Hmmm..

I think this is just what has to happen with mobile banking to get cash:

https://www.macrumors.com/2018/08/01/chase-cardless-atms-apple-pay/

https://www.macrumors.com/2018/08/01/chase-cardless-atms-apple-pay/

At this point DKB or ComDirekt would be the two banks I would consider to reopen accounts, if there the need so witch comes up.@docfred I have the same problem with bunq, i dont see the value for the 8€/month.

I get 3 cards, ok but all debit cards, which can give you problems when renting a car in US.

Getting more accounts: Means to me to look for more accounts that they are in balance so nothing drops and means a lot of changing IBANS for companys I order stuff from. 25 IBANS is just in my eyes a waste of accounts.

I do compare it with the DKB as that is my main account.

I was able to order an additional account with my wife very easily, we have cards for every account (I have 2 Visa+Giro for my account and my wife and I have each an additional visa and Giro for our combinated account), I dont pay any foreign fees anymore in the US (where i am usually once a year and that saved me already at least 50€!).

But OK, other people might have other thoughts about banking, its just my 2 cents about it

But the two hype banks... puh. Expensive for the service provided. And a shiny App is not worth to pay 8 to 10€ per month in my opinion

As I said yesterday, the market is big and wide. Many many nation wide banks on the German market. Which makes this country different to most other markets, Apple and Google had to deal with.

At this point DKB or ComDirekt would be the two banks I would consider to reopen accounts, if there the need so witch comes up.

But the two hype banks... puh. Expensive for the service provided. And a shiny App is not worth to pay 8 to 10€ per month in my opinionbut they will find their customers and niches.

As I said yesterday, the market is big and wide. Many many nation wide banks on the German market. Which makes this country different to most other markets, Apple and Google had to deal with.

Point 1) Just open a free N26 account and then you know that Apple Pay will be supported on day 1 and you don't have hassle in the hectic weeks after the launch when N26 will be overwhelmed by new account openings. What you can do is just transfer money to it and use it for your daily payments until you decide to switch entirely, change your account to a different bank or possibly wait until your main bank offers Apple Pay. And honestly: Who wants to switch to Deutsche Bank? I just named bunq as an example of a true innovative FinTech which has its specific niche. I tried them out and enjoyed some aspects and see them largely as a stopgap until Apple Pay comes to Germany officially. If ING / DKB or Sparkasse joined, then that would help me out as well ;-) And I still have boon. as a backup, as I assume many other here do as well.

Point 2) The German market is much more fragmented than other markets. In the UK (and as far as I can tell also in France / Italy / ...) you'll have a larger number of (retail) banks, of which all operate nationally and have branches in every larger city. In Germany you only have a few private banks which have a fairly small market share in terms of overall private banking customers, a large "online banking" sector (ING / DKB / Comdirect ...) and then of course the co-ops and public banks (over 380 different Sparkassen dotted all over Germany with over 50m customers). So German banking is highly regional / local and "online". Hardly any real nationwide banks such as Societe General, Banque Populaire, Barclays, Lloyds, UniCredit, BNP Paribas, RBS, Nationwide, HSBC and so on. I would only really put Deutsche Bank and Commerzbank in this category. Yes, that makes it especially difficult to manage. It will take time.

@sir-hd Consorsbank won‘t take part at launch:

https://wissen.consorsbank.de/t5/Gi...hr/Apple-Pay-mit-Consosrsbank/m-p/73836#M5837Consorsbank said:Diverse Mobile Pay Möglichkeiten werden im weiteren Verlauf dieses Jahres getestet. Eine Umsetzung für dieses Kalenderjahr ist jedoch aller Voraussicht nach nicht geplant.

New statement from Ing-Diba (similar wording like the old one)

https://www.ing-diba.de/ueber-uns/wissenswert/zahlungsmethoden/

so in end effect: "we dont care what our customers want"

Everything (currently) points me to switch to Deutsche Bank with my bank account + my partners bank account. So we would merge them.

But on the other hand, I think 11,90€ per month is very much. Although I need at least two giro and two credit cards.

But on the other hand, I think 11,90€ per month is very much. Although I need at least two giro and two credit cards.

I would like to add my two cents about bunq. I really love this bank and I dont get the people that are complaining about the 7,99 € a month. Just look at other banks like Sparkasse (not all but most) where you have to pay a monthly fee between 3 and 7 € or more. If you want a credit card you pay another 20 € or more per year. If you want to sent a "instant transfer" they want another 0,50 € per outgoing AND incoming transaction. Only a couple of times per month you can withdraw money for free. So if you count this all together you do not get away any cheaper than with bunq.

Now about bunq, what is it that people love ... what I love about them.

# 1. They have the best mobile app that I have ever encounter to use. Ever tried N26 and how long it takes to open the app? It takes ages! Bunq is open within a blink of your eye. It is a well designed app, that is very nice to look at. Everything is where it is supposed to be.

# 2. Awesome customer support. Within ten seconds you get a support member in the in app chat to talk with you and they help you immediatly. Not those standard copy and paste phrases that other banks tell you.

# 3. Together: Bunq offers a platform called together where people hang out and talk about upcoming changes, ideas, problems etc. Everyone can say what he likes or dislikes and you get a response from people and bunq itself. Lately bunq removed a function where it would allow you to make requests and share those via a link to whatever platform you want (whatsapp, facebook, sms, etc.) With bunq update 8 they removed that feature and people did not like it. There was a lot of people complaining about this and bunq said they removed that feature to keep the app simple. It took them only about a week to give us that feature back after they saw that the people want it back. THEY DO CARE about what their customers want. Pretty much every single feature in the app was an idea of the community. They do what the people want, not what they think is best for the people.

# 4. A variaty of great functions: Like is said for example being able to make requests and sent money from/to anyone. You dont need a bank account number, just their phone number, email, facebook, whatsapp or whatever. Just share the link and collect your money or sent money as easy as that.

Another great feature is dual pin which allows you to connect one card with two bank accounts. Or connect your bank account with your friends or wifes account within 10 seconds. You can set limits in the app like daily budget for your kids or partner or friend. And you can set limits to each card individually for withdrawal, online payment, nfc payment, normal payment etc. You even can select exactly which country you want your card to be able to make payments. Not just like "allow use abroad" no you can specify exactly like "germany, italy, russia". And can set them to expire automatically for example after two weeks disable allowance for russia and it will do it automatically.

Another great feature is the CCV code the regenerates every 5 minutes. Every 5 minutes you get a new 3 digit code which makes only payment and much safer. Of course if you choose to you can disable this feature as well.

There is a dark mode for all the people who love such a design feature.

You can create multiple accounts for specific things like an account where you save for your vacation; one account for your kids; daily expenses and and and ... Stuff people demand from N26 for years and still even though they promised it we are waiting for.

Bunq.me which allows you to do fundraising ... even for non bunq users that feature is available. Just go to bunq.me and create your link, connect your bank account (every bank in europe works) and you are set to go.

Another great thing about bunq, they dont do shady business with our money. No loans, no investments in risky stuff. Your money is safe.

And now the best there is a bunq pack. 4 full accounts for 19,99 €. That makes 5 € per account. Just gather up with some friends and you pay 5 € ... come on if thats not a good deal. In the together community there is a special thread where people are looking for members... you can group up with strangers if you want. I have a place free in my bunq pack in two weeks, so if someone is interested just write me.

There is so much more that is great about bunq. I know its not suited for everyone but you have a free month, give it a try and I promise you, you will love it. If not, thats fine too. If you like N26 you will love bunq. But bunq is not like any other bank. Just give it a try if you are interested in.

Now about bunq, what is it that people love ... what I love about them.

# 1. They have the best mobile app that I have ever encounter to use. Ever tried N26 and how long it takes to open the app? It takes ages! Bunq is open within a blink of your eye. It is a well designed app, that is very nice to look at. Everything is where it is supposed to be.

# 2. Awesome customer support. Within ten seconds you get a support member in the in app chat to talk with you and they help you immediatly. Not those standard copy and paste phrases that other banks tell you.

# 3. Together: Bunq offers a platform called together where people hang out and talk about upcoming changes, ideas, problems etc. Everyone can say what he likes or dislikes and you get a response from people and bunq itself. Lately bunq removed a function where it would allow you to make requests and share those via a link to whatever platform you want (whatsapp, facebook, sms, etc.) With bunq update 8 they removed that feature and people did not like it. There was a lot of people complaining about this and bunq said they removed that feature to keep the app simple. It took them only about a week to give us that feature back after they saw that the people want it back. THEY DO CARE about what their customers want. Pretty much every single feature in the app was an idea of the community. They do what the people want, not what they think is best for the people.

# 4. A variaty of great functions: Like is said for example being able to make requests and sent money from/to anyone. You dont need a bank account number, just their phone number, email, facebook, whatsapp or whatever. Just share the link and collect your money or sent money as easy as that.

Another great feature is dual pin which allows you to connect one card with two bank accounts. Or connect your bank account with your friends or wifes account within 10 seconds. You can set limits in the app like daily budget for your kids or partner or friend. And you can set limits to each card individually for withdrawal, online payment, nfc payment, normal payment etc. You even can select exactly which country you want your card to be able to make payments. Not just like "allow use abroad" no you can specify exactly like "germany, italy, russia". And can set them to expire automatically for example after two weeks disable allowance for russia and it will do it automatically.

Another great feature is the CCV code the regenerates every 5 minutes. Every 5 minutes you get a new 3 digit code which makes only payment and much safer. Of course if you choose to you can disable this feature as well.

There is a dark mode for all the people who love such a design feature.

You can create multiple accounts for specific things like an account where you save for your vacation; one account for your kids; daily expenses and and and ... Stuff people demand from N26 for years and still even though they promised it we are waiting for.

Bunq.me which allows you to do fundraising ... even for non bunq users that feature is available. Just go to bunq.me and create your link, connect your bank account (every bank in europe works) and you are set to go.

Another great thing about bunq, they dont do shady business with our money. No loans, no investments in risky stuff. Your money is safe.

And now the best there is a bunq pack. 4 full accounts for 19,99 €. That makes 5 € per account. Just gather up with some friends and you pay 5 € ... come on if thats not a good deal. In the together community there is a special thread where people are looking for members... you can group up with strangers if you want. I have a place free in my bunq pack in two weeks, so if someone is interested just write me.

There is so much more that is great about bunq. I know its not suited for everyone but you have a free month, give it a try and I promise you, you will love it. If not, thats fine too. If you like N26 you will love bunq. But bunq is not like any other bank. Just give it a try if you are interested in.

Register on MacRumors! This sidebar will go away, and you'll see fewer ads.